How to Work Online from Home

How to work online from home comes down to choice and motivation. Many people want to know how to make money working online. I can give you the motivation and give you the ‘how‘ with this article. But the final decision to actually do it, is yours.

Many people overlook the most obvious benefit of working online from home which is the ability to control and manage your own financial destiny. Making money online is not difficult, once you know the how. But too often people fail online because they gave up way before they put all the pieces together. And there are a lot of pieces.

Making It Easy

Fortunately, I’m going to make it easy for you and give them ALL to you. I am even going to tell you how & where you can join a world class training community that you can start for free and where to access 300 ‘How to’ videos, that cover everything you will ever need to know about how to work online from home.

But first, let’s get you motivated to wanting to work online. Here are some powerful reasons, to make you think hard about getting started.

Some Background

“I have written before about the Government being the biggest problem for the people of the world when it comes to wealth creation and that they are not the benefactors they pretend to be”.

They are actually detrimental to your economic well-being and its time for you to take personal responsibility and create your own online business to save yourself from their mismanagement.

Let Me Explain…

Why I say that Governments are not your friends and they are no looking out for you. Let me give you an example. Many people assume that China will one day become the next superpower and perhaps they might. But things are not always as them seem.

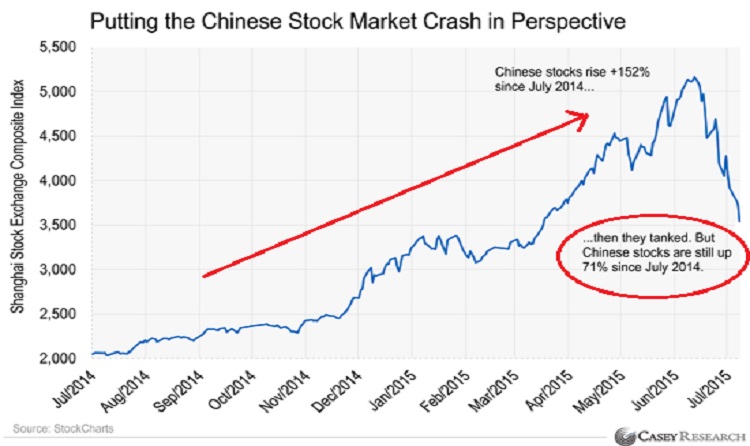

Not so long ago, the Chinese stock markets lost more than 3 trillion dollars in less than a month, following a strong bull market, that had risen 152% over a twelve month period, up until June 2015, before China’s two biggest stock markets suddenly plummeted.

Bubbles always burst much faster than they grow and after expanding for over a year, Chinese stocks crashed 35% in three weeks, meaning that Chinese companies lost around $3.2 trillion worth of value in less than a month.

A stunning loss of wealth and to put this in perspective that’s double the size of the entire stock market of Australia. Yet even though the drop is huge the Shanghai Index is still up 71% from a year ago, so perhaps it still has further to fall.

Why do these things happen? (More about that soon...)

Not the First Time

What you may not remember was that China led the global collapse in 2008, when the stock market ‘bubble‘ at that time saw a massive rise in just two short years before suddenly dropping 72%. So, recent events are not the first time the Chinese stock market has imploded and it won’t be the last.

In Response

In response to the meltdown in 2008 the government (in line with Keynesian economics) pumped Trillions into their economy, building hundreds of thousands of apartment blocks, commercial buildings and developing infrastructure, massively ‘overbuilding‘ basically everything.

Resulting in having real estate and industrial capacity 12 to 15 years ahead of demand. But they didn’t care, they did this to stimulate their economy and to provide jobs for half a billion people who had moved from rural areas to urban cities, looking for work.

Increased GDP

This government funded real estate construction program, artificially boosted the economy and drove up the country’s GDP – making the communist economy look successful, as they weathered the global economic meltdown, becoming the envy of the western world. Despite creating a huge hidden real estate bubble.

This unprecedented overhaul of their economy had actually been going on for decades, but really only got traction from 2009 and after five years of rapid growth, the Real Estate market began to slow, as the number of unsold properties mounted in the face of continued overbuilding and weakening demand.

Economic Out-Look

Economic growth has begun slowing, home prices are deflating (despite offical figures to the contrary) and most local governments are facing a potential debt crisis from all the massive building being undertaken with borrowed funds.

But that’s not all, this is also the same country, where families are only allowed ONE baby and some of those are now in their mid twenties and are also only having one child. But the majority of these babies are still children so, the future demand for ‘Real Estate’ is unlikely to be greater than it was, thirty years ago, when families had five or six children.

What this means is that for every child in China, over the next twenty years or so, there will be up to six older (non working) family members that will need looking after. In other words the ageing population will be massive as the population is shrinking. Making the excess of real estate a larger problem than it is currently.

More Government intervention

The last time the real estate market faced a slow down the Chinese Government responded, to the reduction in demand for government-funded construction projects and a slowdown from falling exports. Was to pump liquidity into the stock market and by actively encouraged its citizens to buy stocks.

The last time the real estate market faced a slow down the Chinese Government responded, to the reduction in demand for government-funded construction projects and a slowdown from falling exports. Was to pump liquidity into the stock market and by actively encouraged its citizens to buy stocks.

The People’s Bank of China even slashed the banks’ required reserve ratio in an attempt to spur lending specifically for stock investing.

So, began another massive bubble in the Chinese economy, as money moved into stocks as the once favoured vehicle for speculation, real estate, was falling from favour.

Stock Prices

Increasing stock prices were being driven by cheap money borrowed by inexperienced retail investors who after years of speculation in real estate, switched to stocks at a time when the Chinese economy and exports were slowing.

| For more on the Chinese Economy see my post here |

All this was because the Government has staked much of China’s future on increased domestic consumer spending. Politically they needed to be seen to be in control of the economy and they needed the ‘markets‘ to go higher so that the people would be able to buy more stuff and continue to drive the economy and also to make them ‘look good‘ (save face) in the eyes of the world.

“Of course these actions cause artificial ‘bubbles’ in the economy, as all governments do, when they meddle in the economy, and if the most ‘Controlling Government‘ in the world can’t save its economy from ruin. What hope does your Government have?”

Today we are seeing the results of that Government intervention. The markets have not created these problems by themselves, they are as always, Government created, irrespective of what type of Government is running the country.

Even More Intervention

China is still worried about the stock market crashing and causing instability, so the Chinese regulators have been trying every trick in the book to stop a crash. They are doing things that only a Government like China can do.

- They have banned short selling (betting that a stock will fall).

- They have suspended all upcoming initial public offerings.

- And they have even halted trading on 51% of Mainland Chinese stocks.

This resulted in investors who own $US2.2 trillion worth of Chinese stocks not being allowed to sell them. The market slowed, even rose a little, but still continued to slide, so the Chinese government took even more, desperate measures:

- They started buying up blue chip stocks to prop up the market…

- They banned pension funds from selling stocks…

- Threatening to jail investors for shorting stocks…

- They Halted 1350 out of 2900 major firms from trading their stocks

- And stopping trades on another 750 that fell 10% or more…

- They began running Positive outlook news stories…

See more here in this informative video below;

But China is Not Alone

I am not picking on China here, rather using it as an example of what governments do. Most Governments are deeply involved with interfering in their economies. Look at the recent problems with Greece defaulting on loans and the many other countries that are in financial trouble. These are not overnight problems but are a result of a systemic governmental heavy handiness in the affairs of it citizens.

China just happens to be able to do what many western governments would like to do, have total control, without any input from its people.

Things will Happen Quickly

China can do things quickly because they don’t have to ‘sell’ the idea to anyone. So expect quick actions from the Chinese Government whenever the hidden truth about its economy begins to reveal itself, as the Chinese Government attempts to ‘manage‘ the inevitable meltdown.

This will include doing things like;

- Devaluation of its currency

- Reducing interest rates

- Selling of Foreign (US) bonds

- Reducing Foreign reserves

- Increased Foreign investment incentives, etc

- Telling Positive Economic News stories

Most Chinese citizens have no idea what its government does, nor realizes what is about to happen, because its government carefully ‘controls‘ the flow of information within China. It controls the internet, foreign news, journalists, books, newspapers and all social media.

Will This Effect Us?

Unfortunately, whatever China does, will impact us because we are vulnerable to any significant decline in the Chinese economy, because China does business with most western countries and whatever is bad for China is also going to be bad for us.

However, things are not much different in the U.S, here they also ‘monitor‘ the flow of information and misinform citizens as to the true cause of the current economic mess.

Most western Governments need laws to be able to act in the way they do. Or if they get caught they then simply pass laws retrospectively to allow them to do what they were not allowed to do.

Essentially, however, all governments behave in the same way, to varying degrees and that is not acting in the best interest of its citizens.

The Free Market

The free-market system in all of its innovation and wealth creation has unfortunately been hijacked by destructive government tamperings in almost every society in the world.

We now increasingly see ‘mafia type‘ behaviour from our own Government with its favouring of powerful lobby groups at the expense of ordinary citizens, whilst pretending to be looking after the best interest of its citizens.

“Its time to wake up and realise that their interference must stop. Time to take back control of your own economic security”.

Why is There a Real Estate Bubble in China?

What is remarkable about the Chinese people, is that they save over half their income and then invest it real estate, even though they don’t own the actual land (since 1949 it’s been leased for 70 years from the government) So, home ‘ownership‘ is high (at 90%) compared to the U.S where it is just 64%.

Most Chinese households have a major proportion of their assets in real estate vs. 27.9% in the U.S So, as the incomes in China have increased, so has their investments in real estate. In Shanghai, for example, real estate values have gone up 560% since 2000, making real estate in China very expensive, despite the massive over-building and government ownership of all the land.

The country’s more informed, affluent and ‘connected’ have been leaving the country in droves, by moving ‘temporarily‘ to major English-speaking cities, in part to get their kids a better education and partly to get their money out of the country.

They are buying up expensive real estate and as a result, have become the leading buyers in cities like Sydney, Singapore, L.A, San Francisco, New York, Vancouver, and London.

In 2014, they accounted for around $22 billion, or some 24% of the total real estate purchases in the U.S alone.

What Does a Crash Mean for China and How will it Impact you?

When the stock market crashes again in China, it will also lead to a Real Estate crash that will cause an unimaginable destruction of wealth for the Chinese and that loss of wealth is going to send shockwaves throughout the global economy, particularly the real estate market, worldwide.

You don’t have to be Einstein to understand what happens when ‘foreign buyers‘ with the kind of buying power the Chinese have had, comes to a halt. It will cause a global real estate meltdown and it will also impact the global economy in many other ways.

Why Millions May have to Sell Their Gold

Historically, gold has held for financial protection during uncertain times. Gold has held its value for thousands of years through wars, depressions, and financial crises. When the stock markets crash or paper money fails, gold has been a reliable store of wealth.

Historically, gold has held for financial protection during uncertain times. Gold has held its value for thousands of years through wars, depressions, and financial crises. When the stock markets crash or paper money fails, gold has been a reliable store of wealth.

Unlike most Americans or Europeans, Chinese people see gold as an important form of wealth protection.

Gold Buyers

Chinese people are the biggest buyers of gold in the world and if the Chinese stocks go into free-fall then many won’t have the cash to pay for margin calls, repay loans or in fact have the cash to buy anything, especially gold.

If the world’s biggest gold buyers suffer a major liquidity crunch. That means that many who have gold will be trying to sell because it’s the one thing they can get cash for. When a large number of buyers are forced to become sellers… well, it’s going to have a negative impact on the global price of Gold.

That’s Not all

There are many other ways that a stock market / real estate crash in China, is going to impact the world. As just one example; China is also the world’s largest consumer of iron ore and is both the world’s largest producer and importer. Global Iron ore prices depend on China and when China’s economy starts slowing down, it’s going to impact countries like Australia.

- Iron ore is Australia’s biggest export and accounted for 25% of the total value of Australia’s exports in 2014.

- 77% percent of Australia’s iron ore exports went to Australia’s largest single trading partner which is China.

In fact, the majority of Australia’s economy depends on commodities as it exports, coal, natural gas, gold, and crude oil. One-third of these exports goes to China.

China’s economic boom was great for the Australian economy, but if China slows down drastically, then Australia is going to struggle.

“So stop waiting for your Government to SAVE you. They got you into this mess. All Governments are the same (whether they be Communist or Not) they no longer serve you. Its time to look out for your own economic security”

So What Can You Do?

You don’t need to take to the streets or protest or cause trouble. You can just quietly go about getting an education to create you own economic security.

If you know nothing about internet marketing then, fortunately, there is an excellent place to get such an education and learn how to make your own money without relying on the government.

Become Educated

A place where you can do it at your own pace and from your own place. You not only get the education that you need to be a successful, long-term, online marketer and create your own future security without waiting for a Government handout, pension or bailout.

You also receive advanced knowledge about website construction traffic generation, SEO ranking, keyword research, content creation and lots of support and help and answers to all your questions from within the membership community.

The Internet is Dominating the Business World

With the internet dominating the business world, becoming an online business owner is a very wise decision and currently, there are thousands who are taking the plunge and joining the community of affiliate marketers.

Wealthy Affiliate is a straight, honest and down-to-earth program. Created by online marketers for those wanting to become online marketers and it won’t cost you a fortune or have you continuously buying ‘upgrades’ and ‘extras’ – like so many other programs.

Best of all you can begin for free and stay a free member for as long as you like and if you elect to upgrade to a premium membership you know upfront exactly how much you will pay and the additional value you receive in exchange is worth way more than the cost.

| You can Join Wealthy Affiliate for FREE here |

Another Option

If you already know something about internet marketing you will know that trying to make money can be difficult. Most people get frustrated and give up and fail because they never finish putting all the pieces together.

However, there is a proven blueprint that cuts out all the struggle and one that doesn’t require you to have any techie skills in order to earn money from using WordPress to create websites.

You can view the link here to uncover more about how to create a website in WordPress and how exactly you can make a lot of money.

| Learn how to create a website in WordPress and make money |

WordPress is one the most popular website builders around with nearly 50,000 new WordPress sites being created every day and I can show you how to capitalize on that growth.

Conclusion

So, rather than asking “What can you do about the Global economic situation” The question should be “What can I do about my own economic situation?”.

The answer may be to have an online business. To learn more about how to work online at home and make money and read a few more pages and posts on this site. How to Work online from home as I have said, comes down to choice and motivation. Hopefully, I have provided you with the motivation and shown you the how.

So now the choice is yours.

Finally

If you have enjoyed this post “How to work online from home” feel free to socially share and leave a comment or ask a question below.

If you leave a comment, I will reward you with a free PDF copy of my book, Video Marketing Made Easy – sent directly to the email you use.

“So, please accept my bribe and leave a comment. The book is awesome and so are you for leaving a comment! Thanks ?

“Oh and if you want to get access to over 300 ‘How To‘ Video tutorials, that will teach you everything you need to know about how to work online from home. You should check out this link below”

| Click Here to Access Over Three Hundred ‘HOW TO’ Video Tutorials on Internet Marketing |

Thanks for your global insight views on working online from home. I believed everyone had benefited from your blog. I also believed everyone is making an effort to earn from home especially to those who are for whatever reasons-mainly accidents making them incapable to work. At which level do you see online business growth in 20, 30 even 100 years ahead; will it become saturated(only sellers no buyers)for a specific products, or their growing graph will always be on ascending order or what it’ll be and why?

Hello, Joseph. I have another post that is more specific about working online and the trends It would be a difficult call to make, 20, 30, or 100 years out as technology changes at a much faster pace now than ever before. It’s a bit like Bitcoin who would have thought that it would ever get to $6000? So you never can tell what the future holds. Thanks for your comments 🙂