How to Invest in Bitcoin

How to Invest in Bitcoin

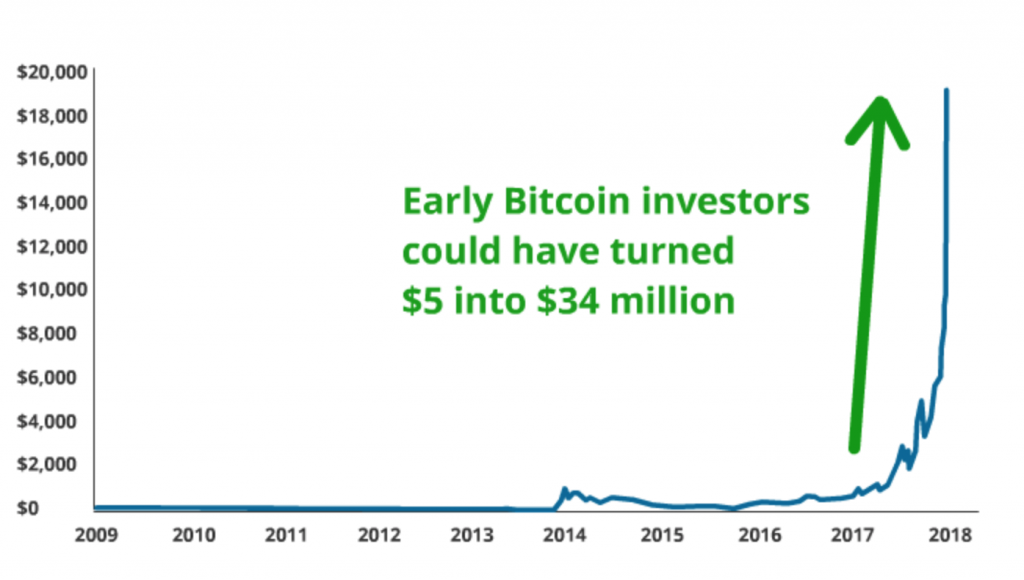

How to invest in Bitcoin and survive, is probably what this article should really be called, because prices had been going crazy for a while now. As I write this, Bitcoin is down almost 70% from the high of December, 18th, 2017, of around $20,000, trading at around $7,000.

![]()

Does this mean that Bitcoin is a dead horse? – No, I don’t think so.

Why Invest in Bitcoin?

So, why invest in Bitcoin if it is such a volatile investment. Well, I’m going to answer that, and more in this post. Firstly, it’s important to remember that since Bitcoin’s creation, it has experienced many deaths as reported via the media, the banks and many so called ‘experts’ in fact, over two hundred times. Yet, it keeps coming back to life. The price changes hourly and could easily rise and fall dramatically, even daily, and significantly as we have seen recently.

To see todays price, in real time see the image below:

Current Bitcoin Price

This gives you the current price for one Bitcoin (1BTC) and it changes regularly.

How To Invest In Bitcoin…continued

But, just because the price is down, doesn’t mean it’s the end of Bitcoin, as an investment.

Just to highlight a few of those many reported ‘deaths’ of Bitcoin.

- It crashed 40% on September 2017, dropping from $5000 to $2972.

- It crashed 80% on April 2013, dropping from $266 to $54.

- It crashed 36% on June 2012, dropping from $7 to $4.

- It crashed 94% between June & November, 2011, dropping from $32 to $2.

And each time Bitcoin has supposely died. Its price at the end of the each crash period, has always been higher, than before the reported ‘bubble’ began. So, the overall trend, has been, and still is, upward.

Worry

If you have been attracted to the new technology and the whole blockchain concept surrounding cryptocurrencies, then you won’t be too worried, by the recent sell off.

If on the other hand you are worried about the massive devaluation, because you bought in, at a higher price, than its selling for today, then you may learn something from what I’m going to share with you.

While it’s true that some people have made a fortune from investing in Bitcoin and you may think that the cryptocurrency boom has already peaked. You may even think you’re too late and I wouldn’t blame you.

The “big money” (hedge funds, institutions and large money managers) aren’t in the cryptocurrency market yet. The total cryptocurrency market is still too small for them to invest. (It sits at around $400 billion currently). But the institutional funds need the ‘market cap’ to hit $1 trillion, before they can start investing. And when that happens, then the crypto market, will really take off.

Institutional Investors will put their money into the cryptocurrencies that have the largest market share. That means smaller investors should be looking closely at Bitcoin and Ethereum, (and a few others that I mention in my book) especially if they want to get in before the institutional investors start investing their billions.

There will certainly be high volatility, along the way, like we have seen already, but I’m suggesting to you, that now’s the time to get in, before the really big money comes. Here’s something else you should know. Bitcoin (and Cryptocurrencies in general), are NOT the only asset class to experience high volatility during their life cycle.

Life Cycles

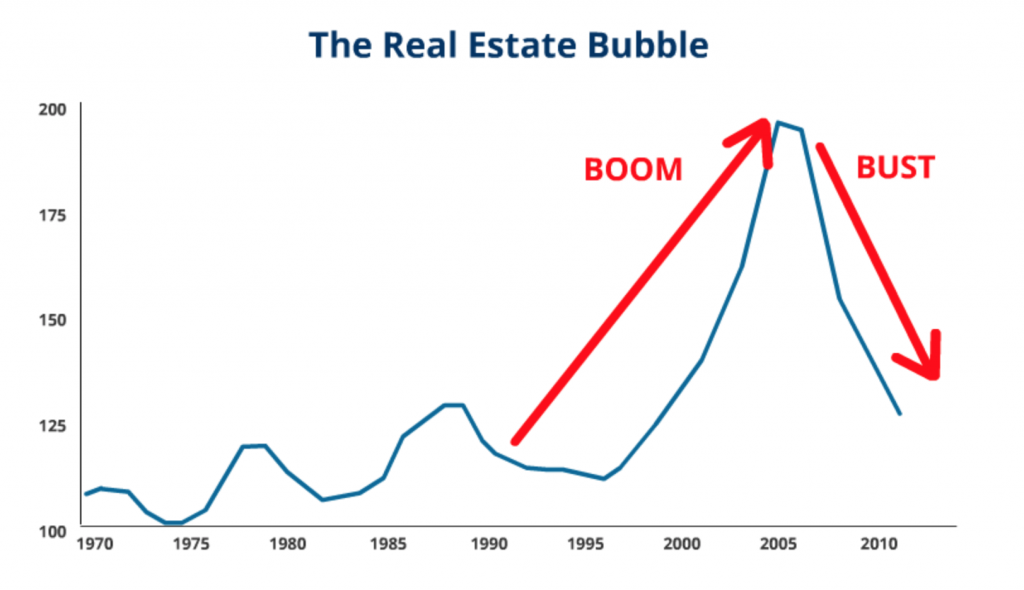

We had the Real Estate ‘bubble’ then a ‘crash’ around 2006. Prices have since stablized and come back from those lows.

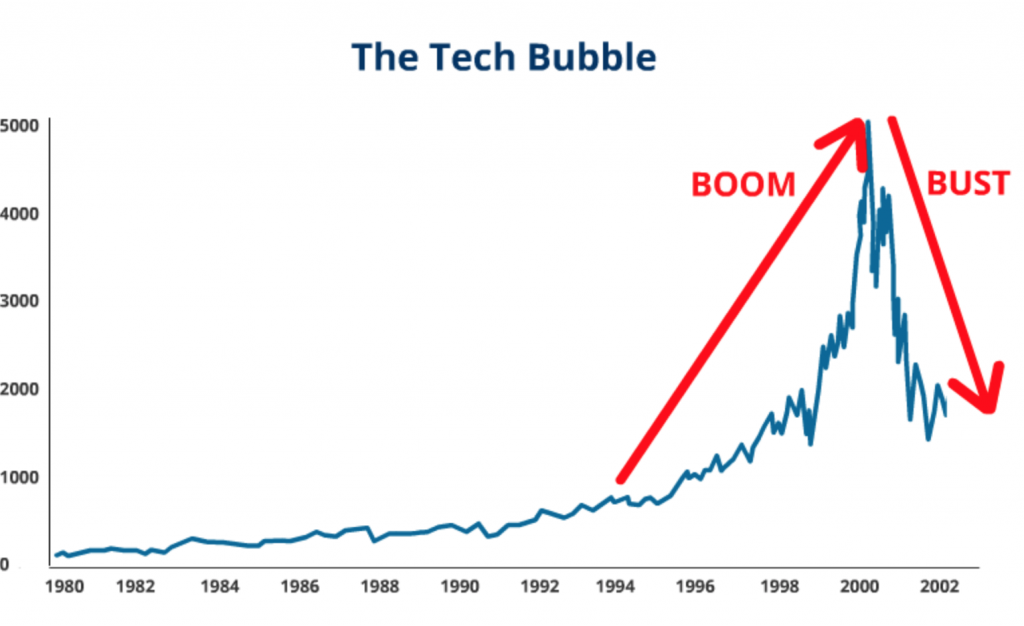

And then there was the Tech ‘Bubble‘ in 1990’s. Yet, despite that massive ‘tech-wreak‘, where many lost a ton of money. Others made a killing, as some of the most valuable companies on the planet (Facebook, Apple, Amazon, Google) came out of that market crash.

A Typical Market Scenario

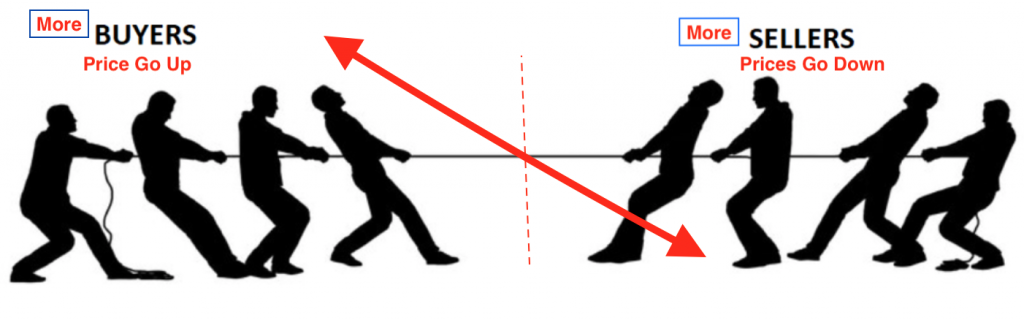

As the market heats up, prices will climb, and as prices climb, new buyers will come in, which will drive up prices even further. Attracting more buyers. Then as the market gets hotter, even more buyers will come. Soon everyone will be talking about how easy it is to make money. It’s no longer about the product or the technology, it’s just about speculating and buying, only because the price is going up.

The prices will get crazy and some people will sell to take profits, some will buy because they don’t want to miss out. Others may get worried that prices will fall, others will worry prices will rise as they are sitting on the sidelines. Others will sell when there is negative news. Some will buy in on those dips. The prices will fluctuate wildly, as buyers and sellers compete with each other.

When those that are buying exceeds those that are selling. It will drive prices upward, making the market very strong. When those that are selling exceeds those that are buying. It will drive prices downward, making the market very depressed.

What it Means

But, here’s the thing, as with any investment, there are always periods of fear, uncertainty and doubt which will bring about lower prices and the weak hands will tend to fade away. That’s actually a good thing, because eventually, it drives out the speculators and the weaker companies, which means that in the long run, the ones with substance are the ones that are going to survive.

So, if you are into Bitcoin, because of the technology and as a long-term investment, then you have nothing to worry about. If however, you are in it, to make a quick-buck, then you will probably get wiped out each time there’s a downturn, like we have just seen recently.

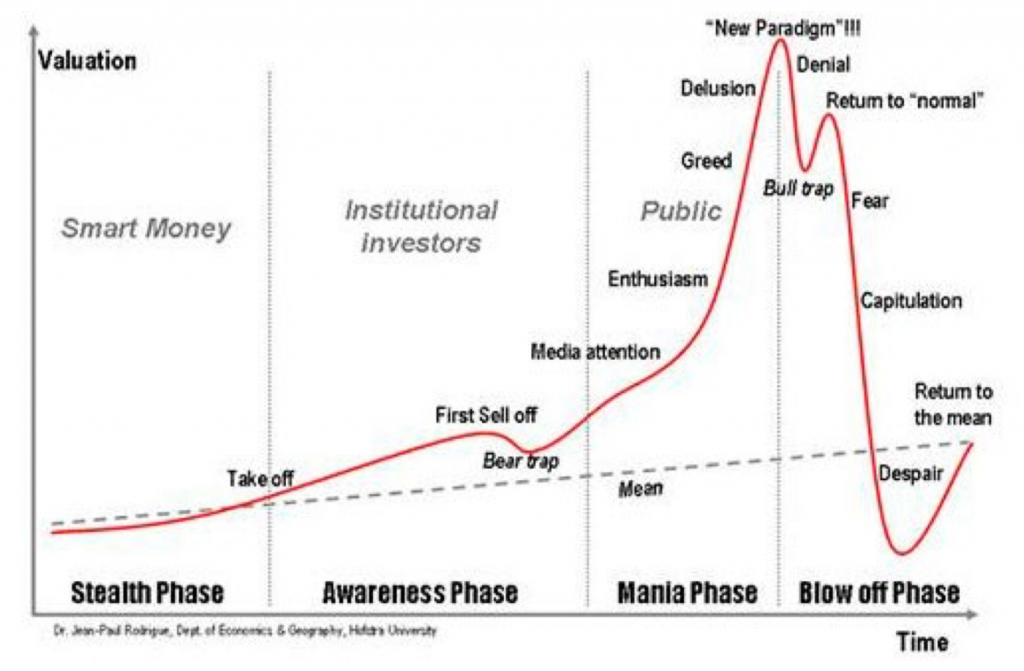

A Typical Market

Take a look at the next graph, which is a typical trend for any new technology or new emerging market, in terms of price and value over time. This has played out many, many times, with the dotcom boom, the real estate market, company stocks, commodities, and many industries and across every market. It would be surprising if the cryptocurrency market does not follow a similar trend.

So, where are we? Probably still in the ‘Awareness Phase’ (depending upon when you are reading this) because the institutional investors haven’t come in yet. Others may argue that we are have just gone through the mania stage, entering into the Blow off Phase. But the majority of the public hasn’t got into the cryptocurrencies yet and the institutional investors are still waiting to get involved. But where ever we are, it’s going to follow this pattern.

Underlying Technology is Rock Solid

I write about some of this, (and much more) in my book “Why Invest in Cryptocurrency? And how to get started“

I write about some of this, (and much more) in my book “Why Invest in Cryptocurrency? And how to get started“

While Bitcoin (and the other digital currencies it has spawned), have experienced price volatility, the underlying blockchain technology has proven to be rock solid.

You’ve heard the term “blockchain” and its association with the cryptocurrency industry and you may even know of the decentralized network that underpins cryptocurrencies.

But that’s only part of the story…

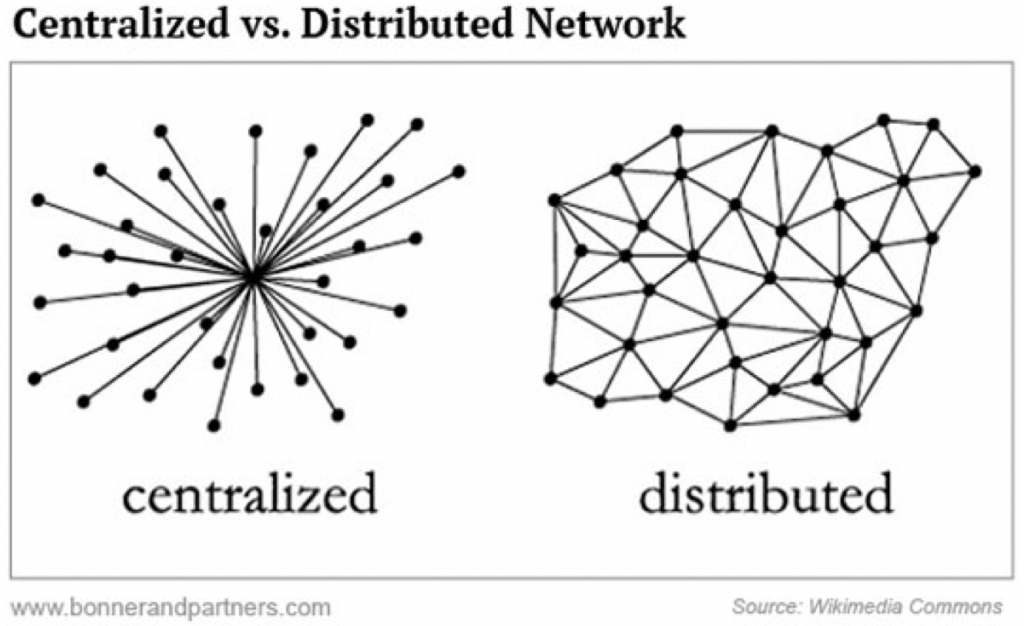

Blockchain technology is also known as a distributed ledger. We can think of a distributed ledger in its simplest form as a distributed database. In the sense that there are complete copies of this database (or ledger) scattered around the world.

How the Blockchain Works

Typically, companies, governments, and individuals keep their records on a centralized database. But there is a major problem with having a centralized database in that it can be manipulated. Records can be changed, hard drives can fail, data can be lost, and the information ‘recorded‘ represent only one party’s view, of any given transaction.

Whereas, in the world of blockchains and the distributed ledger technology, the exact opposite is true. The transactions ‘recorded‘ on the ledger, represent a transaction that’s taken place between the parties involved and is confirmed by the blockchain network via a consensus of thousands of individual computers. Once a transaction is written into the ledger, it is immutable. It cannot be changed.

The following image gives an idea of the difference between these two types of networks. Why Invest in Bitcoin

Why Invest in Bitcoin

So, here’s another reason why you should invest in Bitcoin. The value and utility that a well-designed blockchain provides is remarkable. It provides secure transactions, privacy, transparency, and this part is, key – the elimination of fraud. The problem with a centralized system, is that we depend on “trusted” intermediaries (banks and other financial institutions) to conduct transactions. But as we’ve learned time and time again, these “trusted” intermediaries are not at all trustworthy.

Trust

Not long ago there was a scandal uncovered where many of the most ‘trusted‘ financial institutions in the world, were manipulating interest rates for their own benefit and had done so since 1991. Banks like Barclays, Deutsche Bank, JPMorgan Chase, UBS, Citigroup, Bank of America, and the Royal Bank of Scotland were found to be right in the middle of these manipulations.

And then there was the Wells Fargo incident…

Wells Fargo created millions of fake accounts (an estimated 3.5 million accounts, about 1% of the total U.S population) in order to charge additional fees for services that customers never requested. It was later discovered that Wells Fargo were also signing customers up for unwanted insurance policies, again in order, to charge for services that were never requested.

There is no question whether this was outright fraud or not. But did anyone go to jail? It appears as if these days that governmental and financial institutional corruption is seemingly endless.

Not Just The Banks

But it’s not just the banks, we are also living in the age of identity theft. It was reported that $16 billion was stolen from U.S consumers in 2016. This is an increase from the $15.3 billion stolen in the previous year. In the past six years, identity thieves have stolen over $100 billion from U.S citizens.

This rise in identity theft coincides with increasing awareness that cybersecurity measures are not good enough. In September, 2017, United States citizens endured the Equifax hack, which exposed as much as half of the country’s private information. Also it’s not just the credit companies its also the retailers when you shop on eBay or Target. Both of these companies have experienced massive data breaches in the last five years.

Blockchain Could Be The Answer to Cybersecurity

In an effort to eliminate these risks, companies are turning to the blockchain. When you couple blockchain technology and cybersecurity, you get the perfect marriage.

![]() All of the cyberattacks that digital currency users have fallen victim to, are the result of human error or outright scams, not a failing in blockchain technology.

All of the cyberattacks that digital currency users have fallen victim to, are the result of human error or outright scams, not a failing in blockchain technology.

That said, when you apply this ground-breaking technology to cybersecurity, you can boost efficiency and simplicity. More importantly, you can increase national security, protecting everything from private citizen data to military secrets.

You don’t really need to understand the all the details, as long as you know that blockchain offers the following benefits:

- Distributed data storage

- Cryptographic security

- Consensus-based third-party validation of information

The three traits above are unique to blockchain technology. These measures prevent a hacker or cyber-thief from altering or infiltrating information on the blockchain, providing every individual with better security.

It’s easy to see how this technology can be applied in nearly every industry seeking better cybersecurity, from banks to credit bureaus. It’s for reasons like this that this new technology is so attractive as it enables secure, reliable, and transparent transactions, without the potential for manipulation by big financial institutions.

It’s The New Internet 2.0

By design, blockchain technology removes the potential for manipulation to take place. You can think of this as a “new” internet 2.0. Today’s internet is how we communicate and send pictures, stream videos & music, and send emails. But blockchain networks are different as they allow you to transfer value.

The internet of value will allow you to send money, fulfil smart contracts, confirm your identity without sending sensitive information, and so much more. The way that value is transferred is through its own cryptocurrency. Each blockchain, by design, usually has a controlled, finite supply.

For example, in the case of the Bitcoin blockchain, its cryptocurrency is its means of transferring value and also incentivising its network participants, paying them for doing the blockchain verification work. And the Bitcoin supply is finite, there are only 21 million that will ever be produced.

Think about that a blockchain that has its own value adding monetary policy written into its software. I can’t be inflated, forged or manipulated.

It’s Not Too Late

That’s why I’m still excited about this technology. It has the potential to rewrite our entire society the way the internet did more than twenty years ago. And the assets associated with this technology, and a few very specific cryptocurrencies, will continue to soar in value.

Bitcoin, for example, is a complex and very powerful new technology, Yet it’s actually one of the simpler digital currencies on the market. If you take the time to understand the basics of Bitcoin, then you will understand the other digital currencies.

Despite the digital currency’s volatility and expected surge in prices, most people still don’t understand the concept of the underlying technology that makes Bitcoin so unique. My book is a great resource to have and below I tell you how you can get a copy for free.

Further Reading and Posts

To learn more about the many other types of Cryptocurrencies that  are available and why they may be a good way to protect yourself from the wealth-destroying policies of governments and central bankers. Also with more than 1000+ different Cryptocurrencies now available, finding the ‘right‘ ones can be a daunting experience. You may like to visit my post ‘What is a Cryptocurrency’

are available and why they may be a good way to protect yourself from the wealth-destroying policies of governments and central bankers. Also with more than 1000+ different Cryptocurrencies now available, finding the ‘right‘ ones can be a daunting experience. You may like to visit my post ‘What is a Cryptocurrency’

| You can use this link here: ‘What is a Cryptocurrency’ |

To learn more how Bitcoin is used as digital money how the digital transactions take place and what is meant by a distributed ledger called a blockchain and what it is that make Bitcoin value; Visit my post What Is A Bitcoin?

| You can use this link here What Is A Bitcoin |

To learn more about how this blockchain technology may be the most important single development since the invention of the internet itself. How it’s going to be a game changer. You may like to visit my post What is Bitcoin About?

| You can use this link here: What Is Bitcoin About? |

To learn more about how to buy Bitcoin with cash or, Credit Card, PayPal, Bank Transfer, or any other payment methodology and currency you desire (well almost). I step you through the process and show you how to open accounts and which ones to use that give you the most freedom and flexibility. Visit my post ‘How to Buy Bitcoin with Cash‘

| You can use this link here: How to Buy Bitcoin with Cash‘ |

To learn more about why I think we are only at the beginning of the new revolution in blockchain-related technologies and in terms of the overall development Cryptocurrencies are a small part of that emerging industry. This new technology is going to be a game changer and could be the most important new development since the invention of the internet.

To learn more about why I think we are only at the beginning of the new revolution in blockchain-related technologies and in terms of the overall development Cryptocurrencies are a small part of that emerging industry. This new technology is going to be a game changer and could be the most important new development since the invention of the internet.

| Use this link here: How to Buy Cryptocurrencies |

Finally

Take a look around and review the other posts while you are here and grab a copy of my Book, Why Invest in Cryptocurrency? And how to get started.

If you enjoyed this article “How to Invest in Bitcoin” please share socially and leave me a comment below.

And if you do, I will reward you with a free PDF copy of my Book; “How To Buy Cryptocurrency? And How to get Started“.

Packed with a lot of detail and information that will get you excited about the future of cryptocurrencies and it explains how you can get started, investing profitably.

Peter V Crisp

“So, what are you waiting for?

Accept my bribe and socially share and leave a comment below and I will send you the electronic version, by email of my latest book. How To Buy Cryptocurrency? And how to get started – Thanks!

P.S. You can Buy the Book via Amazon Kindle if you wish, or get the paperback version”.

To bookmark this page for future reference you can do it now using (Ctrl+D)

Hi Peter,

As a bitcoin investor myself, I was immediately attracted to your post.

I was fortunate enough to get into bitcoin in early 2017 when it was about $1000 and totally enjoyed the Dec 2017 rise!

Your article is a great resource and I love the links for other information you provide you reader as well as the ability to get more help through your book.

I still believe that the recent low prices (although last year we were so happy when bitcoin got to $6500) is partly due to manipulation by the ‘big boys’ out there and my gut feeling is they are driving prices down in the hope people will sell, so they can later buy large amounts (so don’t sell (in my opinion)).

Loved the article and just curious, where do you see bitcoin by end of 2018?

Tim

Hello, Tim. Thank for your comments. I am pleased you have enjoyed the write-up and I’m sure you will also like the book that is coming your way. Yes, Bitcoin and indeed the other cryptocurrencies had a wild ride in the latter part of 2017. I think we will see much more subdued market in 2018 although I think the long term outlook for Bitcoin is positive. Thanks again for your comments. :0

Cryptocurrency is definitely on the rise, and with this type of article, you will definitely get a lot of attraction! I have worked with bitcoin in the past and have seen the rise and fall of this great currency. I will be using this guide to refer to when it’s time to get some more information on the coin, or to just refresh my memory. Wonderful article Peter!

Hello, Ryan. Thanks for your comments and I am pleased you have enjoyed my articles. I have a few about bitcoin and cryptocurrencies in general. I m sure you will enjoy the book that is coming your way, watch out for it in your inbox. 🙂

Hi Peter

How I wish I’d come across your site when I first started my crypto learning journey, it would have made it so much easier. Instead I stumbled along researching and putting the story together piecemeal and finally learning what it all meant, implications for banks, how to buy cryptos etc. Your info makes it all very easy to understand.

For now I’m “hodling” my cryptos for the long term.

Hello, Ann. Yes, that a good idea he roller coaster for cryptos isn’t over yet. but long term the out look is strong. Thanks for your comments. 🙂

Hey Peter, Really a super interesting blog post and so good explained I never understood how all that works but with all those graphics even I was able to get it. I never invested in bitcoin because I was at least smart enough to understand that when everybody invests the bitcoin will fall. So now would be a perfect time right? or would you wait for a little longer?

Hello, Aaron. As a thank-you for leaving a comment I am sending you a PDF copy of my book Why Invest in Cryptocurrency? And how to get started It should provide you with the answer to your question so watch out for it in your inbox. You can also view other posts What is a Bitcoin, What is Bitcoin About , How To Buy Bitcoin and What is a Cryptocurrency All these will give you additional information. Enjoy. 🙂

Hi, Your post is engaging and i have learned a lot about Bitcoin by reading this very informative post. This post covered almost all angles – from history, present and future of digital currencies and trading. What I like most is how you highlight technology and cybersecurity (the perfect match) in online interface. This is really a great post.

Hello, BA. Thanks for your comments. Pleased you have enjoyed it. Keep an eye out for the book that is coming your way as a thank-you for leaving a comment. 🙂

I’m not really familiar with bitcoin but I knew when it started almost a decade ago. I believe I’m many of those who would have got rich “if” I have bought a dollar of bitcoin back then. Your analysis sound convincing that the recent drop is not the end. I am considering to hop on the bitcoin wagon hoping it’s not too late.

Hello, Kenny. I am sending you a copy of my book Why Invest in Cryptocurrency ? And how to get started. which I sure you will enjoy. Take a look when it comes as it will help you to decide which Cryptos to buy and how to set up accounts etc. Thanks for your comments. 🙂

As someone who also has a cryptocurrency website It was a plaeasure to read your article and the amount of detail and media in it is exceptional but most importantly the content was researched and was precise.I picked up on the connection between Bitcoin and the technology behind it Blockchain. This article helps the newbie to understand the ins and outs of a market that is still in its infancy and is likely to be around even with its current volatility for a very long time

Hello, Gerard Thank you for your comments. Please enjoy the book that is coming your way. Im sure you will find it very useful also. Cryptocurrencies are certainly an interesting topic right now. Thanks again fo your comments. 🙂

Great article Peter!! Always bringing great topics for discussion and sharing. Thank you!!!

I’d like to know more about how to gain profit through trading. I’d like to read more about that!!!

Hugs!!!

Hello, Luis Thanks for your comments. Yes trading cryptos will be a great topic. Currently though we are seeing a downward run in cryptos, which I talk about in the post. The price will settle (sometime don’t know when) and then it will be far more stable as it begind to moves back up. So it is still going to be a grat long term investment. Cheers 🙂

Wow, thank you very much for this article! I have been trying to wrap my head around blockchain technology and all the currencies surrounding it for some time now. However, after reading your article I feel much better prepared to invest with the long run in mind.

I loved the graph you showed of the “typical market” and how everything is basically cyclical (esp. in the long-run) so really what we should be seeking is the trend. Blockchain technology is already disrupting many industries and will continue to revolutionize how we make online transactions going forward. So, I am still debating which currency I want to invest in and therefore am ever grateful that you provide very useful information in a clear yet concise manner. I will be definitely coming back to this site for updates!

Thank again!

Hello, David. There are some other posts you might enjoy also, How To Buy Cryptocurrency, What is a Bitcoin , What is Bitcoin About , How To Buy Bitcoin and What is a Cryptocurrency

Bill Gates, Richard Branson, and PayPal founder Peter Thiel, to name a few brilliant minds, are all very optimistic about the future of cryptocurrency. The answer to your question can be found in the ebook I am sending your way for leaving a comment, so watch out for it in your inbox.

Thank you for your comments. Enjoy 🙂

When Kyle said provide value, you did that and then some! I read about bitcoin which has been something I’ve been interested in for some time now and as I said in the comment, this is probably the best explanation of crypto currency I’ve ever read. Thanks for that. I’ve actually bookmarked your blog, because I want to read more. The captcha at the bottom is annoying…it kept saying I typed it wrong and I had to refresh the page to try again. Other than that you site is AWESOME!!

Hello, Fizzy. Thanks for your comments and I don’t know what’s up with the captcha? So my apologises, but pleased you persevered. There are some other posts you might enjoy also How To Buy Cryptocurrency,What is a Bitcoin , What is Bitcoin About , How To Buy Bitcoin and What is a Cryptocurrency Plus of course, the ebook that is coming your way, so watch out for it in your inbox. Cheers 🙂

This is probably the most easy to understand break down of the whole cryptocurrency thing I’ve read since I 1st became aware of it. This reminds me of back when I was a kid and my dad kept going on and on about this new thing called “the internet” that was gonna change the world.

Hello, Flizzy Thank you for your comments. Pleased you have enjoyed the post. Watch your inbox for a PDF copy of my book that is coming your way. 🙂

Peter; I have read through your review on Bitcoin and I like your honest approach to the rise and fall of the coin.

Given the outlook and biasness of some reviews that one have read, this review have set things in order. that any one can understand how Bitcoin really works.

At this juncture, would you advise anyone to invest in Bitcoin?

Hello, DorcasW. Thanks for your comments. You will get the answer to your question in the book Why Invest in Cryptocurrency? and how to get started. thats on it’s way to you, so watch your inbox.

But briefly…Many brilliant minds — Bill Gates, Richard Branson, and PayPal founder Peter Thiel, to name a few — are all very optimistic about the future of cryptocurrency.

Bill Gates says, “Bitcoin is better than currency” and calls it “the future of money.”

Bank of America has even teamed up with Microsoft to explore the technology further…

According to billionaire Richard Branson, “[Bitcoin] is working and there will be other currencies like it that may be even better.” His commercial space travel venture, Virgin Galactic, will even accept Bitcoin as payment.

Peter Thiel — one of the original financiers of PayPal — has navigated his worldwide online payment system into a partnership with BitPay and Coinbase to enable Bitcoin transactions for PayPal users.

Big companies like Microsoft, Subway, Dish, Apple, Target, Victoria’s Secret, Whole Foods, Home Depot, CVS, Sears, and Amazon are all starting to throw their hats in the ring. They’ve all started to accept Bitcoin payments in the last few years. This mass adoption has contributed greatly to the meteoric rise of cryptocurrency this year.

Pleased you ave enjoyed the article. 🙂