Real Estate Investing Programs

Getting Started in Residential Real Estate Investing

Can be a daunting task when you don’t have the knowledge or the money to begin. But all that is about to change because this is where you will learn where to get the needed information to find the best real estate investing programs.

“Often times you don’t even need your own money!

Investing in real estate can be an excellent source of income and the key to your financial freedom.

It’s secure and stable and generates passive income day in and day out. Done correctly, investing in real estate can put all your financial burdens at ease and secure a future for your children.

There are Risks

On one hand, investing in real estate is a risky business, especially if you enter unprepared. There’s always a chance that you’ll lose all your investment funds and have to start from scratch, a sad story that we all have heard a few too many times.

The truth, however, is that the business is not as complicated as you might believe. There are simple step by step strategies that you can follow which will guarantee a return on investment and a source of passive income for the rest of your life.

Want to know How to Invest in Real Estate?

I wrote a book called Success Secrets of Real Estate Investors that I (still) sell and it’s a comprehensive guide to obtaining financial success through smart real estate investments.

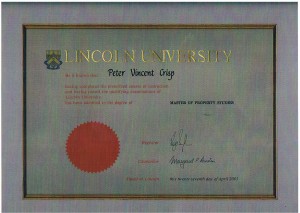

In this book, I take you by the hand and walk you through my entire real estate investment strategy and even though I have a university (Master’s) degree in Real Estate Studies and years of experience as an investor and also as a successful real estate agent.

I simplify it enough for the average person to comprehend the entire concept of residential real estate investing.

“The book reveals how anyone can find cheap properties and improve them to boost cash flow. More importantly, when you’re done reading the book you will have the right mindset to approach investments and you’ll be able to spot cash flow opportunities in every area of your life”.

Best Real Estate Investing Book

What’s in it?

There are case study examples of real estate investment deal that I have personally completed. These examples are written in detail, revealing how I found cheap properties and raised their value to increase rent and create a positive cash flow.

The math is included as well and you can see, in action, how to calculate the potential cash flow of a certain piece of property (and whether or not it’s worth the price of renovation).

You’ll also learn how to take out loans that the income from the properties will pay back without falling into debt.

In this book there are proven strategies that have been real world tested and market proven to make you money. Inside you will;

- Learn Strategies to Create ‘Cash Cows‘ for Long Term Wealth

- See why the real secret to wealth is Passive Income

- Achieve Financial Independence from day one with strong cash flow

- How to properly secure and Finance Your Property for maximum returns

- Learn how to Negotiate Deals with absolutely zero money down

As an included BONUS – I also reveal how I was able to build a portfolio worth MILLIONS in a crashing real estate market while everyone was left to pick up the pieces after the devastating real estate recession of 2008.

Get your copy of: Real Estate Secrets

Real Estate Investing Secret

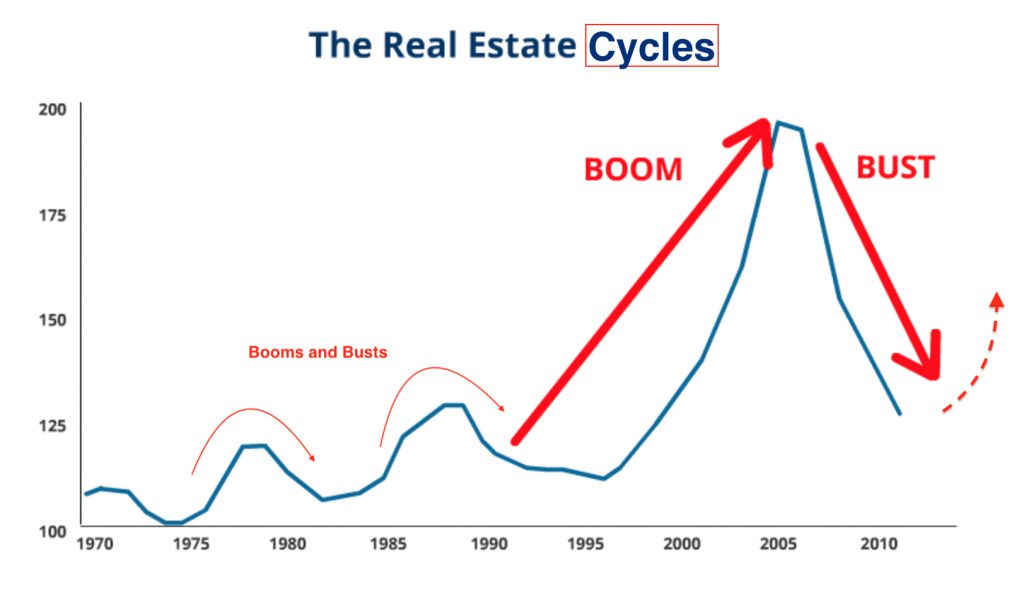

When it comes to real estate investments, most people don’t realize that the market has three cycles: Boom, Flat Line, and Bust.

Boom is up, Flat Line is neutral, and Bust is down, and then the cycle repeats.

Most people often begin to buy during the first phase of the cycle when the interest in real estate investments is heating up and sell during the second phase of the cycle, when the value begins to diminish.

That’s a mistake. You should first determine which phase the real estate cycle is in before deciding to buy, sell or hold onto a property. Because you can often make more money by buying when people are selling and sell when people are buying.

Real estate investment always goes through cycles and the value will increase and decrease and then increase, as the cycle continues on.

“In the book, this concept is explained in detail, and I tell you how you can ride through these cycles and earn a profit without fail, time and time again” (or how to use the knowledge of the cycles to your advantage).

Creative Real Estate Investors

Investors need to know how to use other people’s money to finance property even if they have no money of their own. I’ll show you how you can BECOME your own bank and how your investments can keep throwing off cash so you can reinvest back into your real estate business for years to come.

I will not only show you some simple and highly effective strategies for earning real  passive income, but you are going to learn how you can continue to do this no matter what the state of the economy is like.

passive income, but you are going to learn how you can continue to do this no matter what the state of the economy is like.

You will learn how as a real estate investor you can earn continuous positive cash flows in ways that many ‘regular‘ investors never understand.

The idea is to learn how to create a cash cow, a property that generates profit for as long as possible. You’ll learn how to determine if a property will be a cash cow or not and if it’s worth the cost of repairs.

It involves a lot of math and calculations, but these math exercises can reveal shockingly impressive results, results that no-one would expect. you can get it from here

To get your copy of: Real Estate Secrets you can get it from here

| Get your copy of Real Estate Secrets here |

Best Real Estate Investing Course

There are many ways to make money from real estate and I have included a number of programs for your consideration in this post ‘Real Estate Investing Programs‘.

If you are a new real estate investor looking to learn more about investing in real estate I have a couple of options for you.

One is dealing with foreclosures, bank owned properties (REO’s) and short sales and if that’s of interest to you then it is imperative that you understand that distressed real estate, is very different to investing in “retail” residential real estate.

There are many real estate investment seminars and property education events throughout the year such as, Distressed Real Estate Boot Camps, Fixing and Flipping Houses Boot Camps, Wholesaling Inner Circle, Rehabbing Inner Circle and many other events.

To find out more about these types of real estate investment concepts and in particular Fixing and Flipping Houses, I invite you to a free Wholesaling Real Estate and House Flipping Webinar to understand more about these particular real estate investment strategies. To listen to an industry expert give you the inside scope, see the link below:

| Wholesaling Real Estate and House Flipping Webinar |

“As I have said there are many ways to make money from real estate and it’s just a matter of finding the best way that suits your personal situation or preferences. There is no one-way that is right for everyone”.

Another Strategy

There is another real estate strategy which doesn’t you having any cash or credit and that is the buying and selling real estate mortgages. – I also wrote a book on this too.

‘Note brokering’ is the ‘facilitating’ of the buying and selling of the cash flow or income stream typically from mortgage or lien holders, to investors, who want to purchase them.

A mortgage or other financial instrument that generates a cash flow over a period of time is called a “note”.

Most notes are purchased by paying a lump sum of cash now for the rights to receive those regular future payments. These notes are always purchased at a discount, meaning they are purchased at less than the full value (balance).

In other words a sum of money today (in cash) is exchanged for the right to the regular stream of income in the future.

A Note Broker or a note finder gets paid a fee for facilitating the deal (so you don’t need any money or credit). You find a ‘note’ that can be sold and offer it to an investor (a note buyer who will pay cash today for the future income stream).

“To find out more about this interesting investment strategy, you can click on the image below and discover how to make money with real estate mortgages”:

Real Estate Investing Programs

For those interested in learning about Real Estate Development from a successful Billion Dollar Developer & Coach with Sales in 140  Countries. I have some good news for you. There is a great training program that you may like to investigate further.

Countries. I have some good news for you. There is a great training program that you may like to investigate further.

These are the only teaching eBooks in the world on these subjects. This is a real estate development system that will give you a step by step plan and full explanations at every stage.

With this program there is nothing to hold you back, from undertaking real estate development projects yourself, just the ability to read, comprehend, add, subtract, multiply and divide.

Real Estate Development Made Easy is a program like no other and worthy of closer inspection.

| Real Estate Development Made Easy |

Finally

If you have found this post ‘Real Estate Investing Programs‘ interesting, please share socially or feel free to leave a comment or ask a question below;

If you leave a comment, I will reward you with a free PDF copy of my book; Success Secrets of Real Estate Investors – sent directly to the email you use.

So please accept my bribe and leave a comment. The book is awesome and so are you for leaving a comment!

Peter V Crisp

If you are interested in other titles, you can see more books from me on Amazon: https://onlineaffiliatewealth.com/booksamazon

This is very educational, i am looking for some way to invest my earned money into the real estate business. I think is the best and safest way for investing (in comparison to stocks, for instance) I was mainly looking for options to flip properties for profit. What do you think about buying real estates on foreclosures and flipping them in short periods of time?

Hello, Bob. That has always been a popular option for many people, however it takes money and ‘credit’ and there is risk in the timing of the sales after you have acquired the property. There are other ways to invest in real estate where by you don’t have to exposed yourself to that sort of risk. Some I have offered within the post. Thank you for your comments. 🙂

Looking at the the three phases of the real estate cycle that you have listed it would seem like a no brainer to buy during the bust phase and just wait for prices to go back up. The tricky thing is to be sure where the bottom truly is. In my mind to get a book written by a pro that can help you to identify where you are in the recurring cycle for $5 is really a give away. I am thinking that if you can find a way to buy in the bust cycle with out even attending one webinar you are on your way. Im bookmarking this post

Hello, Everton I hope you enjoy reading my book and I look forward to hearing about how you have implemented what you have learned. thanks for your comments. 🙂

Hi Peter, reading this kind of stuff gets me excited for future possibilities in investment. This is a topic I don’t know much about but am interested in learning. You had me hooked in the first few sentences. Considering that at the moment the real estate market is pretty competitive is there a better time to get into it or does it not really matter when you jump in? I will definitely be keeping an eye on what other stuff you’re writing about. Thanks a lot.

Devon

Hello, Devon.

When it comes to real estate investments, most people don’t realize that the market has three cycles: Boom, Flat Line, and Bust.

Investing in real estate is a risky business, especially if you enter unprepared and you are unaware of the cycle you are in. Boom is up, Flat Line is neutral, and Bust is down, and then the cycle repeats.

However, the business is not as complicated as you might believe. There are simple step by step strategies that you can follow which will guarantee a return on investment and a source of passive income.

In terms of most major cities right now are in the Boom phase. So while you may still make money in the short term – if you are ‘flipping’. As for a ‘buy and hold’ then the next phase that is coming along is the Bust phase – so prices will be going down.

Exactly when and by how much I cannot say. Thanks again for your comments.

I have couple of real estate investments in Taiwan and Thailand. The reason is, I live there and I travel to Southern Asia from time to time, so I am familiar with this area. Back to 2008, when the financial crisis happened, I lived in Raleigh, NC, I also have couple chances to invest in real estate, but I didn’t do it. The reason is just what Peter mentioned in his ‘Real Estate Investing Secrets’ I didn’t know if the cycle bottom had come or not. I think everybody should learn how to invest on real estate no matter where you are if you want to keep your wealth growing.

It is amazing to find Peter selling his book, Success Secrets of Real Estate Investors, on Fiverr, for only $5.00 not on Amazon or somewhere else for a lot more. It is creative and a great read.

Thank you for your articles! Hope to get further advice and guidance from you about what you think of real estate market trend in Shanghai and other Asian major cities.

Hello, George. Thank you for your feedback. When it comes to real estate investments, most people don’t realize that the market has three cycles: Boom, Flat Line, and Bust. In terms of Shanghai and most major cities right now are in the Boom phase. So while you may still make money in the short term – if you are ‘flipping’. As for a ‘buy and hold’ then the next phase that is coming along is the Bust phase – so prices will be going down. Exactly when and by how much I cannot say. Thanks again for your comments. 🙂

Investing in real estate has always been a dream of mine and not that I am retired, I actually have the time I need to start investing. Your article is very informative and thanks for covering the risks involved in real estate investment. For me, that gave your article so much credibility. Your book is a must have. To have examples of year real estate deals you completed is invaluable. Great article! I have found myself on your site for the last hour or so just reading your many very informative articles.

Leroy

Hello, Leroy. Pleased you have enjoyed my site and yes I do have a range of topics that I cover and all things that I have experience and passion about about. Thanks for your comments and I hope you enjoy the eBook that is on it’s way to you. 🙂

I have always been one for earning extra income in real estate, and about 10 years ago was well on my way to doing that until our stock market crashed pushing interest rates up to as much as 23% – and I had 5 beach front properties that I couldn’t afford or get rid of – so I have never been lucky that way … but I do so wish I had your advice during those times

Hi, Laurie Thank you for your comments. I am sending you an eBook as a thank you for leaving a comment so watch out for it as I’m sure you are going to like it. 🙂

I enjoyed your Post about investing in real estate. You have given me a lot of great information and I plan to share this Post with friends who I know are interested in real estate investing as well. Have you ever heard of online companies that are REITS? Its a new trend where you can invest in real estate with any amount you have. They put your funds together with other people’s funds and buy commercial real estate. You make a percentage. Not sure if you have heard of this or what you think? Is it a good way to invest?

Thanks for giving the risks about investing as these are good to know and remember. Thanks, Matt

Hello, MattyB. REITS are not new they have been around for a longtime and yes they are easy to get into because you don’t need a lot of money, but a littler harder to get out of. One thing about them though is you have no control over the types of investments the trust buys and frankly, Commerical Real Estate (especially shopping malls) are very risky right now. There are other investments that you can make and opportunities that actually don’t require any of your own cash and I highlight those in my post. Thanks for your comments and feedback. 🙂

I have been looking into buy-to-let properties for the past year, and have started with my first one this year. Always looking to upskill myself and learn more about the industry.

Just wanted to ask about the e-book. Will this be applicable to someone in the South African market, or is it specific to the USA market? Also, is the book available as a hard copy?

Hello, Just. In terms of the book , an electronic copy has been sent to you as a thank you for leaving a comment. It’s not available in hard copy and the principles can be applied to most western countries where they have land ownership (for example not China) Appreciate your feedback. Cheers 🙂

Very interesting read Peter. I also a real estate practitioner myself. I also plan to create an e-book about real estate investing. I would like to ask if you offer co-authorship for your e-books or sell it as a private label rights? Thanks for the info. Will be grad to sell e-book about real estate someday 🙂

Hello, Win Happy to help out in any way just PM me and we can discuss your ideas further. Thanks for your comments. I appreciate the feedback 🙂

Hello Peter. It was very interesting to learn about the concept of a cash cow, and how you can take properties and improve them to make money. Will Success Secrets of Real Estate Investors help someone who has no experience learn how to get started in real estate investment? Thank you so much for this informative article, and I am looking forward to hearing from you.

Hello, Brandon Fortunately for you there is a copy of that book coming to you for leaving a comments so I sure you will have the answer to your question. Thank you for your comments. 🙂

Hello there. Great and informative articles on real estate. Just a question, are these tips, tricks, methods and secrets that you have in your books applicable in any market throughout the world. are there different analysis required for different countries? I am from Malaysia and the property price here is super high and not affordable. it’s getting worse every year. Will the be a phase where it will drop flat. Is the property bubble theory true?

Hi, Veena. Property bubbles are true and there is a global one currently in play right now which should be popping within the next few years (always hard to say exactly when).

Chinese buyers are a major force in the real estate market around the world as they are seeking to find a safe place for their money as the Chinese economy is not as strong as the world believes. But insiders there know differently and are getting cash out as fast as they can and buying real estate around the world is one way to do that.So that has created a boom in property for the moment. But that’s about to end soon.

Here’s why; It’s not just the mismanagement of the various governments around the world that will lead to the NEXT fast approaching, massive economic crisis. It is occurring because of something that is far more understandable and ˜manageable˜ than the political B.S you have been told.

Here are the Facts; In 2008, the world’s largest and richest generation in history, ˜the Baby Boomers˜, began withdrawing from the economy, reversing the previous major spending and borrowing trend that had been going on for the past four decades.

The biggest spenders in the economy are now scaling down their lifestyles, curbing their spending habits, readying themselves for retirement. Soon more and more of them will spend less and less, they will cash out of the stock market, sell their large homes and other non-essential assets and generally spend a lot less money.

All of which is having and is going to have a major impact on the global economy, including China. So the money will stop flowing into real estate and the crazy prices we are currently seeing will crash very fast and hard.

But until then prices will continue to rise, so you can still make money in the short term.

Thank you for your comments. 🙂

A most interesting read!

I am passionate about real estate and never knew about Mortgage notes, lots of great information in this article and easy to read and take in the information.

i have seen the graph for the real estate bubble before and it is a very good indicator of when to buy or sell.

I’m bookmarking this website!!

one question, can your methods be used in the U.K. ?

Hello, dalwhu I’m not sure if they have a public note buying industry in the UK. This is something the banks do but it may be off the radar and you will need to research it. Thanks for your comments and I am pleased you enjoyed the post. 🙂

Thanks Pete!

As far as Cashflow is concerned, real estate is hands down one of the best vehicles for acquiring this. Maybe joint tied or second only to generating cashflow online.

Totally agree with you that one has to get educated first before diving into it so it’s great that you’re providing a variety of information sources on a variety of types of real estate profitable ventures.

Hello, cvguider. Yes you are right, Investing in real estate can be an excellent source of income and the key to financial freedom. It’s secure and stable and generates passive income day in and day out and as you say so does affiliate marketing if you do it right. Thanks for your feedback 🙂

I think the property flipping is huge as long one has the knowledge of what to look for. I think from reading your article here… you have the solutions to help someone interested in this.

I’ve always been interested in flipping but somewhat of a ‘chicken’ to take steps.

I’ve heard of people being successful in the ‘no money down’ and acquire property.

What do you recommend for me if I’m interested in ‘flipping’?

Thanks very much for the great information!

Monica

Hello Monica. There is link to a free webinar within the post that you may find useful. Plus of the books which talk about different investment strategies (as flipping is only one of many) Thank you for your comments and I am pleased you have enjoyed my post. 🙂