Fix Credit Score Fast

Fix Credit Score – FAST

If you are looking for ways to fix your credit score fast, getting hold of your credit report is an important first step toward fixing your credit.

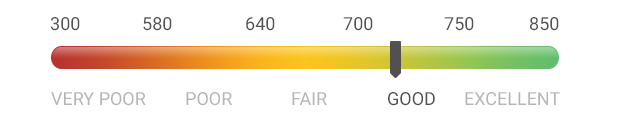

“Most people’s score is somewhere between 500 – 700 which is poor to fair”.

Do You Know Your Score?

There are several ways to obtain a Free Credit Report Online and I’m going to give you access to your credit reports right here, for free. You can contact the following sources directly by visiting;

- https://www.annualcreditreport.com/

- Experian https://www.experian.com/

- TransUnion https://www.transunion.com/

- Equifax https://www.equifax.com/

Why You Need to Do This

You will need to view all these sources to make sure they are scoring you all the same, and once you have your credit report(s), then we can get to work on improving your credit score. Also reviewing your credit reports regularly helps you to catch potential problems, before they get out of hand, such as detecting identity theft, which can devastate your credit rating.

How Important is Having a Good Credit Score?

Having a good credit score will guarantee you of a good life and having the best credit score, you possibly can is important because your Credit Score will affect your;

- loan interest rates,

- credit card approvals,

- apartment rental requests,

- and even job applications.

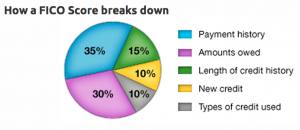

So, knowing what to look for will also help prevent future, long-term credit related problems and understanding how your credit score is calculated is another important step towards improving your credit rating.

Get This Book

Repairing bad credit is a bit like losing weight, it’s going to take a little time. And often, most typical, quick-fix options can potentially be detrimental, over the longer term, which is not what you want.

Repairing bad credit is a bit like losing weight, it’s going to take a little time. And often, most typical, quick-fix options can potentially be detrimental, over the longer term, which is not what you want.

However, as everyone’s situation is different, improving your Credit Score could be easier than you think but you need to get the correct information that’s specific to your individual situation.

So, if you’re interested in learning how to fix credit your score, fast and learn some hacks and how to improve your credit score, then grab a copy of this book.

It will teach you how to avoid all the issues that people with low credit scores have to deal with on a regular basis.

“Details about the process and exactly how to ‘tweak‘ things to improve your score, are found in this eBook”

Start a Business

In difficult financial times many and layoffs people turn to self employment or a business to start to rebuild their income, but how do you choose a profitable business in hard economic times?

Debt Negotiation could be an the answer.

Debt Negotiation could be an the answer.

In fact you could even start a business with the information you are going to learn and this could become a business for you by helping other people negotiate their way out of debt problems. There will be a lot of people looking for this type of help and you will also be genuinely helping people.

You will also have the satisfaction of knowing that you have helped them change their life for the better. A debt negotiation business for example would an excellent business to start in a recession. Your potential customers will be actively looking for the service that you offer and there will soon be a boom in the numbers of people search for these types of services.

For More Information

For more about this and many other ideas on debt and credit management and how to beat the Debt Collectors and becoming debt free you may like to visit another free website; Debt Management Ideas and view the articles and resources about managing your money, managing loan repayments and other debt related topics.

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.