What is a Bitcoin

What Is A Bitcoin?

Don’t worry if you don’t know too much about Bitcoin. It was little known when it first got started in back 2010. It wasn’t until mid 2013 when it shot up from a few cents to more than US$ 1,000 which was it’s first claim to fame.

Still, by 2015, very few people owned any Bitcoin and the price had receded to around US$ 300 and stayed there for more than a year and the total market at that time was only about $4.4 billion.

It’s only in 2016 that the price of a single Bitcoin had slowly risen to around $700 jumping to $1,200 in early 2017. But from there it has quickly risen, massively, to more than $7,000 in October and November, capturing global attention and stunning investors.

Then it hit $8,000 went past $9,000 and then exceeded $10,000+…

Which is pretty amazing right!

“In fact that’s so astounding that there has never been anything like it before!

Overall the price has risen almost 75,000,000 percent since its inception eight years ago.

You can see todays Price here;

The total market is now around $300 Billion, which is significant, as is the daily trade volume. But what’s really interesting is it’s about to get a whole lot bigger.

Why?

- For one, Bitcoin recently broke through US$ 11,000+ per coin and that created a lot of global attention, now everyones talking about Bitcoin.

- Two; Limited Supply – There are only Twenty-One million Bitcoins. Ensuring that’s it value will rise as demand and interest continues to grow.

- And three; Institutional Investors don’t yet own Bitcoin.

Institutional Investors

Institutional investors are hedge funds, big money managers, sovereign wealth funds with billions of dollars to invest. Usually these big money investors are the first to invest in ground breaking technologies, but with Bitcoin it’s been different.

As institutional investors collectively manage trillions of dollars it shuts them out of any market that is too small ($100 Billion or so) and also they need to be able to hedge their bets. So until now institutional investors haven’t been able to do that with Bitcoin.

But that’s about to change, because the Commodity Futures Trading Commission (CFTC) has recently given the go-ahead for the two big Chicago-based derivatives exchanges to launch Bitcoin futures trading. Opening the door for institutional investors to begin investing and that will send billions, perhaps even trillions of dollars, flowing into Bitcoin.

Limited Supply

There are only 21 million bitcoins that will ever exist and 16.7 Million of those coins have already been mined. Meaning that nearly 80% of Bitcoin’s total supply is already in circulation.

There are only 21 million bitcoins that will ever exist and 16.7 Million of those coins have already been mined. Meaning that nearly 80% of Bitcoin’s total supply is already in circulation.

The rest will slowly enter the market over the next 123 years. Ensuring that’s it value will continue to rise as the demand begins to exceed supply.

To put Bitcoins ‘limited supply‘ into perspective, there are some Thirty-five million, US millionaires, but there are only, twenty-one million Bitcoins, so not every millionaire can own a Bitcoin.

What Is A Bitcoin and How Does It Work

Bitcoin is used as digital money that is transacted online, designed for the purpose of exchanging digital information securely via a process known as cryptography. The digital transactions take place directly between buyer and seller and are recorded in a distributed ledger called a blockchain.

Blockchain transactions are fast, secure and global, and are actioned immediately within a secure environment, are confirmed within minutes, and is processed via a global network of tens of thousands of computers. Meaning it is decentralised and not reliant upon a single central source or middleman to confirm or approve the transaction.

When used as a medium of exchange this blockchain technology, gives you ultimate control over your money. Your transactions are safer and very secure and are immune from any government manipulation, influence or confiscation.

Privacy

So, you will be able to pay and receive money anywhere in the world at any given time. Without the unnecessary costs of traditional monetary transactions nor the suspicious, prying eyes of the government and its agencies.

If you are a seller, these transactions have the advantage of being impossible to track or to be reversed. Unlike your normal everyday currency which is subjected to arbitrary governmental regulations, capital controls and transfer rules and currency exchange requirements. – It’s YOUR money!

What this means is that these transactions, due to its decentralised nature don’t need validation or oversight from banks or the government, to work. What’s more the transactions are totally secure against hacking due to it’s decentralised network which keeps a consensus on balances and transactions. Giving you back control over your accounts and your financial affairs. Something that governments have steadily taken a way from you over the years.

Bitcoin vs’ Traditional Currency

Bitcoin is far more valuable, than any paper currency, as central banks around the world have been steadily destroying their currencies through inflation. They have also cut interest rates to almost zero and in some cases, even dropping rates below zero.

Yet these radical measures which were supposed to “stimulate” the economy, hasn’t worked. Instead, all these central bankers have done is hurt everyday people that have money in their accounts, cash in their wallets or money invested in retirement accounts.

“A few dollars invested in Bitcoin would have grown by more than 10,000% a year”.

Inflation

Understand that inflation is solely the work of government, as governments control the creation of all paper money. Just since the last financial crisis, they have created trillions of new currency units, out of thin air. But this is not an isolated incident, its been going on for a long time.

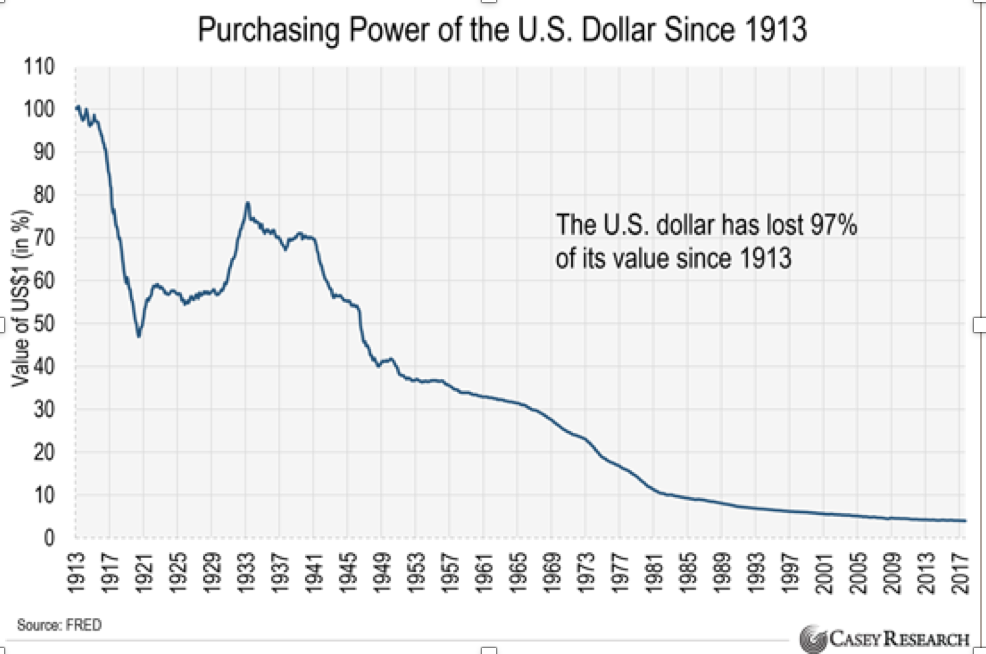

Just look at this chart of the US dollar.

It’s lost 97% of its value since 1913.

Keep in mind that the U.S dollar does has some ‘value’ as it’s still the world’s reserve currency. Whereas places like, Venezuela, Zimbabwe, and most of the Third World countries, their currencies are almost worthless, by comparison.

But there was a time when the US dollar was a much more valuable currency than it is today.

As Good As Gold

After World War 2, the US had the largest gold reserves in the world and as a result of winning the war, it was able to reconstruct the global monetary system around the US dollar.

The new system, created at the Bretton Woods Conference in 1944, tied the currencies of almost every country in the world to the US dollar, through a fixed exchange rate. The US dollar was then tied to gold, at the fixed rate of US$ 35 an ounce.

The Bretton Woods system made the US dollar the world’s premier reserve currency. It effectively forced other countries to hold dollars for international trade, or to trade with the US to get dollars.

America’s March Deeper into Socialism

America’s march towards socialism began many years ago, even before FDR. But it was President Lyndon Johnson, who stepped into power after the assignation of Kennedy, that was an admirer of FDR and who was determined to revive and complete what he believed should have been integral parts to FDR’s socialistic New Deal.

Johnson, called his program, The Great Society and as a part of this ‘Great Society’ Johnson greatly expanded the federal government’s roles (and increased spending) in education, welfare and health care. He initiated the War on Poverty, a policy initiative that remains in existence today that wastes Billions of dollars anually.

LBJ also expanded the war in Vietnam, promising Americans they could have both Guns and Butter. Instead they got greater government interference and meddling in their private lives and a lot less freedom and a legacy of, ‘governmental spending’ that far exceeding its income. (for more on this see: https://mises.org/wire/lyndon-johnsons-terrible-legacy)

Socialism

Socialism always promises heaven but creates economic hell. The lesson from socialist failure around the world (just like communism), is that when a system based on lies and ignores the most basic principles of economics, it destroys even the richest country. In the end, the socialist promise of free money, is very expensive for all.

It was the same in Germany during the Weimar hyperinflation (1923). Prices went wild as the money became worthless. The economy shrinks and you might have a billion marks in your pocket, but you were not able to find much to buy with it.

Look at Argentina in 2001, or Zimbabwe in 2006, or the recent events in Venezuela as an example of another economic disaster zone. As an OPEC country, it’s not the low price of oil that has created hyperinflation, depression and disaster, rather its two decades of socialism. But unlike the US, Venezuela and other countries, could not export their inflation.

Although Venezuela has the largest oil reserves in the world, and was one time the wealthiest country in South America. As a result of government sponsored socialism, promising of ‘a chicken in every pot‘. It has gone from being an exporter of oil, to an importer. Its state-own oil company has gone from being one of the most profitable in the world, to being more than 43 Billion US dollars in debt. (for more on this see; https://mises.org/wire/venezuelas-default-disaster)

Money Printing

By the late 1960s, excessive spending on warfare and welfare programs necessitated that the US government print more dollars than it could back with its gold reserves. As the sheer number of dollars circulating drastically increased, this prompted foreign countries to exchange their dollar holdings, for physical gold.

This lead to a seriously negative drain on the US gold reserves. To plug the drain the next President (after Johnson) was Nixon, who in 1971, instead of reducing spending and balancing the Federal budget. He ‘temporarily‘ suspended the dollar’s convertibility into gold, which effectively ended the Bretton Woods system and severed the dollar’s tie to gold.

Devaluation of the Dollar

The “temporary” suspension is still in effect today. The death of the Bretton Woods system had profound geopolitical consequences. Most critically, it eliminated the main reason foreign countries needed to hold US dollars, or to use dollars for international trade.

Oil-producing countries began to demand payment in gold instead of rapidly depreciating US dollars. The US dollars’ day as the world’s premier reserve currency looked set to end and the consequence of billions of surplus dollars coming back to America was going to create economic mayhem and finally expose the folly of socialistic economics.

A New Deal

However, President Nixon and Secretary of State, Henry Kissinger, to their credit, concocted a scheme that was a geopolitical and financial masterstroke, (in fact pure genius) that gave foreign countries a compelling reason to continue to hold and use the US dollar.

From 1972 to 1974, the US government made a series of agreements with Saudi Arabia that created a new financial order that would greatly benefit the US and save the US dollar.

They picked Saudi Arabia because of the kingdom’s vast petroleum reserves and its dominant position in OPEC and because the Saudi royal family was (and still is) easily corruptible.

The new arrangement would preserve the dollar’s special status as the world’s top reserve currency. It was a paradigm shift in how the international financial system would see the value of the US dollar even though it was no longer backed by gold.

“This is also why Nixon went to China, to open another market for the US dollar”.

The Petrodollar

The new financial arrangement was dubbed the ‘Petrodollar System’ which in essence was an agreement that the US Government would protect and guarantee the Saudi Royal families survival.

In exchange, Saudi Arabia would:

- Use its dominant position in OPEC to ensure that all oil purchases were to be solely in US dollars.

- Recycle those billions of US dollars, from oil revenue into US Treasuries, American weapons manufacturers and infrastructure companies.

- Use the US banking system in New York for it’s oil transactions.

A Financial Masterstroke

Every country needs oil and if countries needed US dollars to buy oil, they have a very compelling reason to hold US dollars in reserve. Think about this… If a country wants to buy oil, it has to purchase US dollars on the foreign exchange market to pay for the oil. This creates a huge artificial market for the US dollar.

If foreign countries are using dollars for oil, it’s also easy to use dollars for other international trades. The dollar is just a middleman, but it’s used in countless transactions amounting to trillions of dollars that have nothing to do with US products or services. So in addition to oil sales, the US dollar is used for about 80% of all international transactions.

It was a financial masterstroke because the petrodollar system is the reason why people and businesses everywhere take US dollars. Ultimately, the petrodollar boosted the US dollar’s purchasing power. It forced foreign governments into taking up many of the new money units the US Government created. Shifting the inflationary effects of excessive printing to other countries.

This also gives the US unmatched political leverage and geopolitical power. The US can sanction or exclude virtually any country from the US dollar-based financial system, which means it can also cut off any country from the vast majority of international trade.

Biggest US Export

Today, the biggest US exports are dollars and government debt. The US government can create unlimited quantities of both from nothing. The petrodollar system helps create a liquid market for the dollar and for US Treasuries. The US can issue debt and also finance previously unimaginable budget deficits.

It also allowed the US government to spend large amounts on welfare benefits for over half of its population. And to finance the world’s largest military, which is bigger than the next seven largest militaries in the world put together.

It’s Why America Remains a Superpower

The petrodollar has given Americans a much higher standard of living than they would have had otherwise allowing them to exchange petrodollars for real things like French wine, Italian cars, electronics from Korea, or Chinese manufactured goods.

The world’s need for US dollars has allowed the United States government as well as Americans to borrow at lower costs, granting them an advantage in excess of $100 billion of free money per year.

It’s the reason why the US government could finance enormous and permanent deficits without destroying its currency through massive money printing and inflationary monetary polices.

It’s the Reason for US Foreign Policy and Wars

The US government could never have become as powerful as it did without the petrodollar. It’s hard to overstate how much the petrodollar system has benefitted the US. It’s been the bedrock of the US financial system for the last fifty years.

It is also the bases from which governs all US foreign policy and intervention in other countries affairs and why there are wars in the Middle East. It’s also the reason why the US political elite pamper to the Saudis.

“Which is why every American President makes a pilgrimage to Saudi Arabia?

But It’s Coming To An End

But this is all about to change, the US dollar’s dominant position as a global reserve is being challenged because of the growing excesses of US dollar monetary units.

Much of the global financial crisis is to do with too much credit and not enough cash. By cash I mean income production, not the printing of physical money. Printing more money doesn’t make you wealthier.

The Europeans have tried to emulate the US dollar with the creation of the euro which entered into circulation on 1 January 2002 and is used by 19 of the 28 member states in the eurozone in an effort to also export the inflationary effects of printing money. But to less effect, and it’s the reason why there is now a financial crisis in Europe.

Also a report released by the United Nations Conference on Trade and Development in 2010, called for abandoning the US dollar as the single major reserve currency. The report states that the new reserve system should not be based on a single currency calling for a new reserve currency based on the Special Drawing Rights (SDR), managed by a new global reserve bank in order to create a more stable global financial system.

That’s Not All

Not only that, but both Russia and China have expressed a desire to see an independent currency replace the dollar as the worlds reserve currency and the Chinese in particular are challenging the US on that very idea as they too, want to export their currency to avert a massive inflationary bubble that’s waiting to implode there.

Not only that, but both Russia and China have expressed a desire to see an independent currency replace the dollar as the worlds reserve currency and the Chinese in particular are challenging the US on that very idea as they too, want to export their currency to avert a massive inflationary bubble that’s waiting to implode there.

To that end on November 30, 2015, the Chinese yuan (RMB) officially became a part of the IMF’s SDR currency basket.

This now makes the Chinese RMB a third placed reserve currency behind the Euro and the US dollar. Also China, Russia, India, Iran, Turkey, Brazil, Venezuela and other oil-producing countries have recently agreed “to transact all of their mutual trade and investment in their own currencies” effectively minimising, at least in the short term, the need to use the US dollar.

The World Financial Crisis

The Global financial crisis is really about central banks across the world recklessly printing money. It’s a giant race to the bottom. Every paper currency in the world is now rapidly devaluing and approaching its intrinsic value, of zero. Countries that cannot export their currencies are getting hit the hardest and first. It’s only a matter of time before the rest of the worlds currencies suffer the same fate.

Governments around the world have been mismanaging their economies for decades and putting the financial security of their citizens in grave danger. Your Government is not looking after your interests, instead they are all self-serving, at your expense and your future security is in eminent danger.

People are waking up to this fact and are looking to take back control of their financial affairs and their privacy. Some are wanting to put their future security back into their own hands and not rely upon the whims of ‘self-serving’ politicians and out of control governments, bent on destroying the economy, hence the attraction of Bitcoin as an alternative to traditional money.

Fortunately

We’re on the cusp of another paradigm shift in the international financial system with the advent of cryptocurrencies.

The good news is that Bitcoin is a decentralised currency. There isn’t a central bank or government in the world that can manipulate its supply or control its users.

But it’s not just about using Bitcoin as a currency. Bitcoin has certain rules, known as the Bitcoin protocol, which makes it work. The ingenious part of Bitcoin is the invention of the blockchain technology which could be the most important development since the invention of the internet.

It’s going to be a game changer because it’s going to change the way business gets done, how documents are exchanged, how real estate is registered, bought and sold, how stocks and bonds are tracked, how inventory is managed and how people transact their private affairs.

Other Cryptocurrencies

But Bitcoin is not the only one. There are now more than a 1000 other cryptocurrencies such as Ethereum, Litecoin and Ripple, just to name a few.

But Bitcoin is the first cryptocurrency invented and remains the most sought after and over the years its value has risen tremendously from almost zero to over $8,000 per Bitcoin. Its transaction volume has exceeded 300,000 daily transactions.

While it’s still a good time to invest in Cryptocurrency, because its still early days. Knowing where to start and how to invest in this new asset class could be an overwhelming and daunting task, if you don’t know what you are doing.

Which why its time to get educated about Cryptocurrencies and learn how you can invest and profit from them and the reason I have written an eBook “Why Invest in Cryptocurrency? And How to Get Started” that you can access for free below.

Summary

So what is a Bitcoin?

- It’s designed for exchanging digital information securely using cryptography.

- It’s a new form of currency that’s going to change the world.

- It’s going to be far more valuable, than any paper currency.

- I’s supply is limited – There are only Twenty-One million Bitcoins.

- Bitcoin is the inventor of the blockchain technology.

- It’s going to get a whole lot bigger.

In July, Japan made all digital currencies, including Bitcoin, exempt from its 8% consumption tax. Now there are over 260,000 outlets accepting bitcoin payments in Japan. Already in the US the number of merchants accepting Bitcoin exceeds 150,000 and they include big companies such as PayPal, Microsoft, and Dell.

Further Reading and Posts

To learn more about how to buy Bitcoin with cash, or Credit Card, PayPal, Bank Transfer, or any other payment methodology and currency you desire (well almost). I will step you through the process and show you how to open accounts and which ones to use that give you the most freedom and flexibility. You can see my post ‘How to Buy Bitcoin with Cash‘

To learn more about how to buy Bitcoin with cash, or Credit Card, PayPal, Bank Transfer, or any other payment methodology and currency you desire (well almost). I will step you through the process and show you how to open accounts and which ones to use that give you the most freedom and flexibility. You can see my post ‘How to Buy Bitcoin with Cash‘

| How to Buy Bitcoin with Cash‘ |

To learn more about the many other types of Cryptocurrencies that are available and why they may be a good way to protect yourself from the wealth-destroying policies of governments and central bankers. Also with more than 1000 different Cryptocurrencies now available, finding the ‘right‘ ones can be a daunting experience. You may like to see my post ‘What is a Cryptocurrency’

| ‘What is a Cryptocurrency’ |

If you enjoyed this article “What is a Bitcoin” please feel free to socially share or leave a comment below.

And if you do I will reward you with a free copy of my book; “Why Invest in Cryptocurrency? And How to Get Started” packed with a lot more detail and information that will get you very excited about the future of cryptocurrencies and shows you how to start investing.

So what are you waiting for?

Accept my bribe and socially share and leave a comment below. – Thanks!

To bookmark this page for future reference you can do it now using(Ctrl+D)

Hey Peter,

That’s an incredibly interesting article and impressively thorough. I guess my question is when I buy bitcoin and send money, where is that money? Am I essentially just buying stock in the bitcoin company and they give me a bit of money to move around? What happens if federal regulation starts outlawing cryptocurrencies since many of the things that you’re talking about (privacy, no regulation) go against many governmental ideals these days? Sorry about all the questions but it’s a very interesting topic. Thank you for the help!

Hello, and thank you for your comments. I actually answer that question and others in my book Why Invest In Cryptocurrency? Which I am sending your way, so watch out for it in your inbox.

Also you may like to review my other posts What is Bitcoin About and How To Buy Bitcoin and What is a Cryptocurrency This will give you a great overview and insight into the interesting and exciting opportunity. 🙂

I would have to say without a doubt that your site is an authoratative site. Very impressive history of economics and the back story of bitcoin. I am very attracted to the privacy point of bitcoin staying out of government eyes. This is the first time i’ve heard of the petrodollar. I would love to hear your thoughts on what the US will do if China decides to collect on its loan to us. I do wish I knew about this when it first started. I would have been more financially secure today. When did you first discover bitcoin?

Hello, Candice. Thanks for your comments. It’s been my discovery and research into Bitcoin that has allowed me to accumulate the knowledge, to write these posts and to also write a book about Bitcoin. The book Why Invest In Cryptocurrencies? Is coming your way, so watch out for it in your inbox. 🙂

What an amazingly informative article!! I have been reading more about Bitcoin but I never really knew that much about it. You really did an awesome job at explaining about the US dollar and why the need for cryptocurrency is so important now. There is a documentary on Netflix that I want to watch as well, have you seen it?

I haven’t invested any money in Bitcoin yet but I have downloaded the app Coinbase where you can purchase Bitcoin and a few other cryptos. What I don’t understand is, how can you purchase only a small amount of it and not a full Bitcoin? Would I just be investing in a portion of it if I bought $100 worth?

Hello, Nicki V. Thanks for your comments. Yes, you can buy a fraction of a Bitcoin.You can buy a portion of a coin 0.0000001 for example. So few hundreds can get you started very easily. Watch out for the eBook Why Invest in Cryptocurrencies? that is coming your way as personal thank you for leaving a comment. Cheers Peter.

HI Peter your website is the best has all the information’s ,and useful materials that visitors can read ,the theme is good and is outstanding ,and i think information is most important ,because the visitors are looking for information ,this your site have ,the way you arrange your sidebar is ok ,i feel like at you are ahead ,wish you all the best

Hello, Yusu. Thank you so much of your comments. I am pleased you have found my post informative nd interesting. I am sending an eBook your way so watch out for in your inbox. Cheers :)I

Hi Peter, Thanks again for this guide about Bitcoin.

I have always found your site very informative and hence love to visit anytime I need to find out something around your niche. Bitcoin is a trend now and due to that, I thought I had to do some research before deciding whether it is right that I jump on it as a bitcoin newbie. I think I have found great value reading about bitcoin from your site. Thanks very much.

Hello, Nyaaba. Pleased you have found the information useful and I am also sure you will like the book Why Invest In Cryptocurrency? Interesting as well. Watch out for it in your inbox. Enjoy 🙂

There is so much information in this post, it is overwhelming. Very well written and a history on bitcoins which are fairly new. The history lesson on Lyndon Johnson is something a lot of people should definitely read about. Also the crypto currency books would be fascinating to read and maybe invest in one or two.

Hello, Bill. Pleased you have enjoyed the post. I do have a few others that you might also like.What is Bitcoin About and How To Buy Bitcoin and What is a Cryptocurrency Plus of the eBook that is coming your way. Why Invest in Cryptocurrency?

Thanks for your comments. 🙂

Wow… You have provided me a lot of information about Bitcoin and I have bookmark this article for further reading. The content is full of information and is very useful for novice like me. It excites me about the potentiality of Bitcoin.

The value of Bitcoin jumped so much this year. I remembered 3 years ago, when I approached one company producing bitcoin machine in Singapore, at that times Bitcoin is still in infancy stage.

This is exciting stage for many people to jump into this bitcoin arena.

Thank you for this article.

Hello, TYP Thanks for your comments. I am pleased you liked the article. You might also like to see my other posts What is Bitcoin About and How To Buy Bitcoin and What is a Cryptocurrency and of course the eBook I am sending your way Why Invest In Cryptocurrency? Enjoy 🙂

Hi Peter!

Thank you for very informative and detailed article. About six months ago got a job proposition from a different country and they supposed to pay me with cryptocurrency. I thought for a while and then refused, because I did not know much about bitcoins. Yes, I did some research, but still, I had no Idea how to use bitcoins in my daily life for routine purchases. I wish I could read your article that time. It is unbelievable how the price went up.

Hello, Alla. It is still early days or Bitcoin and Cryptocurrencies. Please check out the eBook I am sending your way Why Invest in Cryptocurrency? I’m sure you will find the information interesting. Thanks for your comments. 🙂

Hi Peter; thumb’s up to you for your detailed information outline in this article. From time to time I have been getting invitations to buy into Bitcoin business but no one have given the education necessary for a start. Your post is eye opening and helpful. Much have been said but it is Bitcoin that captured my interest. My question is: will you tell me where I can purchase Bitcoin.? DorcasW

Hello, DorcasW. Thanks for your comments and your question. I have several other posts that will answer your Bitcoin questions How To Buy Bitcoin and What is Bitcoin About and What is a Cryptocurrencyas well as the eBook Why Invest In Cryptocurrency? . Which is coming your way as a personal thank you for leaving a comment. So watch out for it in your inbox. 🙂

I have been interested in Bitcoin for the last few years now. You have well explained what this bitcoin business is all about. I have a greater insight on what is happening economically around the world. This post also helped me understand why Gadaffi was murdered. He was a threat to the entire global economic system.

I hope to participate in purchasing Bitcoin. I’m a little concerned with the limitation of bitcoin. It sounds like only some people will benefit from this digital currency. If I want to join in later from the sounds of it if its reached its capacity I wont be able to. Maybe I’ve misunderstood this. But that is how I’ve interpreted this.

This financial masterstroke isn’t a myth it is definitely real and we all feel the effects of its massive destruction.

Hello, Jamie. Thanks for your comments. You might like to read some other posts I have on this subject How To Buy Bitcoin and What is Bitcoin About and What is a Cryptocurrency plus of course the book I am sending your way ‘Why Invest in Cryptocurrency? And How to get started’

This will give you a ton of interesting information about this new emerging technology. Enjoy 🙂

I first heard of bitcoin back on TWiT, This Week In Tech podcast back in 2010 or 2011, I wish I would have taken the time to learn more about it then.

I downloaded a mining program but never could figure it out. It’s still a little confusing. Cool informative post.

Thanks for help explain it better.

Hello, Greg2112. Thanks for the comments. Pleased you found the post informative and happy you have left a comment. Hope you enjoy the eBook that is coming your way. 🙂

Great source if information! i will take your offer on that free copy of “why invest in Crypto Currency.” I have known very little of bitcoin but you literally broke it down very well and how we can use it to our advantage and looking forward to investing into it. Great post!!

Hello, Daniel. Thanks for your comments. I am happy send you a copy of the eBook. So watch out for it in your inbox. I sure you will find it most interesting. Enjoy 🙂

I had a chance to buy some bit coin currency in 2015 for around $500 each coin. Man I wish I would of taken advantage of that deal then. With bit-coin still rising in value at $9,000, I would be ecstatic today.

Such an amazing concept.

Is it true that wants bitcoin hit’s a certain amount in existence. A cap will be placed on it’s mining. Supposedly this will happen around the year 2140. After that, miners will have to rely on transaction fees to stay financially operational.

But isn’t that the beauty of bitcoin today? No middle men, no fees?

Hello, Flowstash. Yes, those things are good as is the fact that it’s a decentralised network that can operate outside of government intervention and control and puts the power over you money back into your own hands. I hope you enjoy the eBook that is coming your way. 🙂

It’s crazy to see such rise in price for bitcoin! I’ve been following bitcoin and other cryptocurrencies everyday for half a year now and I’m still getting surprised by certain “events” all the time. Bitcoin has a bright future and a lot of other cryptos as well. It’s still a great opportunity to invest because the price will only continue to rise!

Hello, RichPersonality. Yes, I agree. As I point out in my post there are several reasons for this and not the least is the limited number of Bitcoin and it’s growing popularity can only put an upward pressure on the price. Thanks for your comments. 🙂