Free Credit Score Online

FREE CREDIT SCORE ONLINE

There are several ways to obtain a Free Credit Report Online, and I’m going to give them to you right here. You can contact the following sources directly by visiting;

- https://www.annualcreditreport.com/

- Experian https://www.experian.com/

- TransUnion https://www.transunion.com/

- Equifax https://www.equifax.com/

There is also another website for getting a free credit report online with the additional advantage that they will monitor your credit and future credit inquiries. They will email you about any new developments to your credit score.

You can check it at Credit Karma.

One of the biggest credit misconceptions is that checking your credit score will hurt your credit score.

This is not the case. You can check your credit scores at Credit Karma as often as you like without affecting your credit score.

What to do Next

You will need to view all these sources to make sure they are scoring you all the same, and once you have your credit report(s), then we can get to work on improving your credit score. You should also research as much information as you can about debt management.

Having the best credit score, you possibly can is important because your Credit score will affect your mortgage rates, credit card approvals, apartment rental requests, and even job applications.

Also reviewing your credit reports regularly helps you to catch potential problems, before they get out of hand, such as detecting identity theft, which can devastate your credit rating.

Knowing what to look for will also help prevent future, long-term credit related problems and understanding how your credit score is calculated another important step towards improving your credit rating.

How is Your Credit Score Calculated?

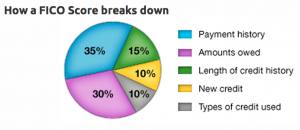

As you can see; it’s your payment history and the amount you owe that makes up 65% of your score. This, together with how long you have had any credit, makes up 80% of your FICO score.

These are the major components that go towards calculating your overall credit score and these have all taken ‘time‘ to acquire and compile.

Most People Have a Poor Score

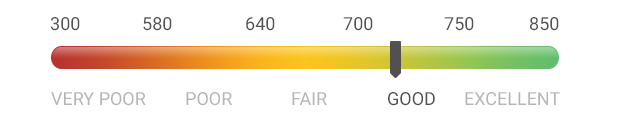

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.

The chances are that you also have a poor credit score, and you’re looking for ways to improve your score.

The good news is that’s simpler than you might think, and no, it doesn’t involve using agencies or expensive services.

In fact, it’s quite easy to improve your credit score on your own, and you can do it for free, it only takes some dedication, a little knowledge, and some will-power.

I have had my share of experiences with having bad credit, from not paying my bills on time. Having bad credit means having to endure higher interest rates and lots of harder work to reduce your debts due to harsher terms and longer payment plans that you get stuck with.

Wait – Didn’t I just say that improving a bad credit score was easy? Why did I just say it was hard for me?

Well… because for me, it was hard because, I owed millions of dollars and had filed for bankruptcy. I initially thought it would be really tough to improve my credit rating, increase my credit score, so I could reduce my interest payments to a more acceptable level.

I was searching for someone to help me with my problems, I went through a lot of agencies and service providers, I tried many different techniques, to improve my credit score. I read a lot of books and tested many strategies and during my search for a solution, I discovered something interesting…

It turns out, it all came down to me. I was the solution.

So, after trying many advertised courses and agencies to improve my credit score, and failing. I decided to take matters into my hands.

I figured out that there are a few simple but concrete steps that almost anyone can make, to improve their credit score – by at least 100 points, in a few short months, possibly even in a few weeks.

These are simple steps, and I wished someone told me about them earlier before I spent all my time and a lot of money on other courses and products which only lead to frustration and further debt.

Well…

Since you’re reading this post, there’s a good chance that you’re looking for ways to improve your credit score as well.

There’s no need for third-party services or accountants; it’s all in your hands… and it’s quite simple.

I outline the steps and provide the information you need to improve your credit rating in my book. In this book is what I wished I found when I was suffering from poor credit. I say suffering because of having a poor credit score is like suffering needlessly with poor health when the cure is only a course of antibiotics and a little time. – If only you knew!

It’s the exact information that I needed to know, to not only improve my credit score but this information has allowed me to maintain a high score, ever since.

I will always have a great credit score now that I found out how to efficiently manage my score – and I’ll show you how you can do the same.

See the Video below for more information:

[To get this book use this link]

Got Bad Credit and Want it Fixed?

Repairing bad credit is a bit like losing weight, it’s going to take time.

There is no permanent quick fix. In fact, many typical quick-fix options are more likely to be detrimental over the longer term, which is not what you want if you are looking for a long term solution.

However, everyone’s situation is different so Improving your Credit Score is possible in a short period. But as a general rule, it won’t happen overnight.

“The bottom line is that rebuilding credit is more like a marathon, not a sprint”.

So my advice is to get this book and read and understand how the credit scoring process works so you will know what YOU need to do to improve your score.

| How to Improve Your Credit Score |

Why Should You Fix Your Credit Score?

Most people don’t pay that much attention to their credit score and end up encountering problems that could have been solved earlier if they had monitored their credit on a regular basis (such as using Credit Karma).

They find out too late!

So, if you’re wondering if it’s necessary to fix your credit score, here are some reasons:

- Banks will not lend to people with bad credit; this means you might not be able to get a loan for college or any other bills.

- Interest rates are higher for people with poor credit.

- It is much harder to acquire a mortgage with poor credit.

- You will have a hard time getting a credit card.

- Some landlords will check your credit score and may refuse to rent to people with poor credit or a history of late payments.

- Cell phone contracts will be difficult to obtain.

- Insurance will be more expensive.

- Buying a car will be a hassle.

- Getting a job will be difficult as employers want responsible employees.

- And much more.

Essentially, a poor credit score makes your life much more difficult, so it’s important to obtain the highest score possible.

In This Book…

In this book, I’ll show you how to read your credit report and take up any issues with your credit agency, because a lot of agencies make mistakes on their reports that are not good for your credit score.

You can then follow up with these companies and make them amend adverse issues in your credit report, and I explain how to do just that in this book.

I’ll also make it easy for you to understand how credit score works and how different companies calculate the score because some companies assign a positive score to some things and other companies assign a negative rating, every credit company calculates scores differently.

The process

The repair process takes times because “fixing” a credit score is more about fixing errors found within your credit history (if they exist and often they do) then following the guidelines as outlined (in the book) to maintain a consistently good credit rating for the future.

“Details about the process and exactly how to ‘tweak‘ things to improve your score, are found in the book – we will briefly touch on a few things below”

Once you have a copy of your credit reports you begin the process by ‘Disputing Errors‘ and playing it smart. Now remember before you contend any error, there are two points you should consider:

1. Does this error negatively affect my credit rating?

2. Do I have documentation to back up my objection?

If the answer to question one is No. Then no action is required. Sometimes credit errors can improve your credit rating, so be selective about what you want to correct.

If the answer to number two is No. Make sure you have documentation to support your claim before you seriously consider making a complaint or going about correcting the error because you need to prove your assertion, remember that even though it a credit report about you, it is NOT your credit report.

Making Effective Choices

These are discussed in greater detail in the book, but the most commonly found errors on a credit report are for a ‘late-payments.’ Many times payments on loans are reported as being paid late when in fact you were never late paying them. So it’s important to check these carefully.

Whenever you are dealing with ‘late-payments‘, it’s important to remember that the older it is, the less damage it has on your current credit score. So target the most recent ‘late payments’ first.

Before you contact the credit agency, contact the creditor. Sometimes if the payment was late because of the mail or a banking error, they might agree to forgive an isolated incidence of a late payment.

Alternatively

If you have made some ‘late-payments’ and your report looks bad as a result, a way to fix this (if it’s possible for you) is to consider offering the creditor payment of the full balance of the loan in exchange for deleting the entire record of ‘late-payments.’

This usually works, as the creditor gets the full amount due, early and you get the advantage of losing the record of ‘late-payments’ on your credit report. Most of the time creditors are far more concerned with repayment than messing up your credit history (Unless your creditor is a bank, they won’t care).

Another thing is that there are two kinds of inquiries that occur on your credit report. These are either a hard or soft inquiries. While both types of inquiries enable a third party to view your credit report, only hard inquiries can negatively affect your credit score. It’s in your interests to know the difference between the two.

Much more is covered in the book, but here’s another idea you might like to know about…

Rebuilding your Credit

We will now look at just one of several ways to get a good credit score, even if you start from nothing. You can build your credit rating by having what is commonly known as an ‘available’ credit limit. This is an unsecured debt in your name (for example, credit cards and store cards, in particular, are a good way to do this).

What is an Unsecured Debt?

Unsecured debt is easy to remember, just think of any loan you have that is ‘unsecured’ By this, I mean things like your mortgage or a car you have a loan on is ‘secured‘ because the asset is the security for the loan. Everything else is unsecured.

“You may need to look at your credit report to see how many credit cards you have and exactly how much credit is on those credit cards”.

For example; Let’s suppose you have two cards totaling $2,000 of ‘available’ credit. Now many people mistakenly think that having a low ‘available credit’ limit that they are a better credit risk.

But in truth, this makes you less attractive to a credit company or a lender than someone that has two credit cards totaling $20,000 of ‘available‘ credit.

You need to build up your ‘available credit’ to improve your credit score.

Sounds crazy right? You might ask?

“How can having access to more debt improve your credit score?

Here’s the Secret

A significant contribution to a good credit rating is your ‘debt-to-credit ratio’. This allows future credit lenders to see exactly how much you have borrowed in the past and how much interest you paid each time.

This will help them determine if they,

(a) Should lend to you and (b) How much they should lend you.

Your debt-to-credit ratio is calculated in percentages.

For example, if your debt-to-credit ratio is 50%; this means you have only borrowed and then paid back up to half of what your credit limit was. [Which is Good]

If you have an 80% debt-to-credit ratio, this means you have borrowed 20% less than what you have as your credit limit. [Which is not so Good]

Ideally, you need this ratio to be around 10–30% at any given time [Which is Great]

Additionally

Also, there are a lot of little factors that can impact your credit score. These factors are little known, and most people don’t know about them… actually, most of them don’t seem fair at all. Regardless, I’ll show you that a lot of these small changes can add up and soon you’ll have a better credit score.

For example, another little factor that people don’t know affects your credit is your ZIP code and your gender. Obviously, it’s impossible to change your gender, but it is possible to change your ZIP code.

… More about this, and much more in the book

Also, you can get more Debt / Credit tips and ideas from here

| Debt Management Ideas |

“Remember, it’s also important to always pay bills on time so don’t sign-up for any payment plans that you’re not 100% sure that you can pay back within the required time-frame!

Burn that into your brain and you’ll never have to deal with problems that arise from poor credit ratings!

So, if you’re interested in learning about some hacks and quick solutions to improving your credit score, then all you have to do is grab a copy of this book.

It will make a big difference, and you’ll be able to avoid all the issues that people with low credit scores have to deal with on a regular basis.

“So bottom line Don’t try and do it on your own. Get this book and learn what to do and how to do it”.

Ten Things You Shouldn’t do to Repair Your Credit

(Sourced from an article by LaToya Irby Credit/Debt Management Expert)

If you’re thinking about repairing your credit, or even if you’re going through the process now, there are some things you shouldn’t do. Here are ten credit repair mistakes you want to avoid.

- Not repairing your credit at all.

Perhaps the biggest mistake of all is putting off credit repair indefinitely. Even though most negative information will fall off your credit report after seven years, that’s still a long time to live with bad credit.

- Disputing EVERYTHING on your credit report.

This is a tactic often used by credit repair companies. There are two problems with trying to repair your credit this way. First, it’s not believable. If you dispute too many items, the credit bureaus could dismiss your dispute as frivolous. Second, you don’t want everything taken off your credit report. Some items are actually helping your credit rating and disputing them could cause your credit score to drop.

- Hiring a credit repair company.

Credit repair companies don’t have a good reputation for achieving good results. In fact, the Federal Trade Commission has been quoted as saying it’s never seen a legitimate credit repair company. Credit repair companies often make lofty promises that they can’t legally fulfill. In the end, you’re better off saving your money and doing it yourself.

- Canceling credit card accounts.

A lot of people don’t realize that closing a credit card can be bad for your credit score, especially if it’s a credit card with a balance or one of your older credit cards. You’ll never improve your credit score by closing a credit card, so think twice about canceling one.

- Playing the balance transfer game.

Transferring credit card balances to avoid making a payment is only postponing the inevitable. This tactic will only take you so far. Considering the balance transfer fees that are added to your balance each time you transfer it, the amount you owe continues to grow rather than shrink.

- Cutting up your credit cards.

A lot of people who go through a period of bad credit swear off credit cards. But, without them, you could have difficulty getting new loans or other types of credit. Not only that, using a credit card the right way will help rebuild your credit as you go through the repair process.

- Missing some credit card payments in lieu of others.

Prioritizing your payments is a smart move. But skipping some payments is not. If you want your credit to improve, you should not miss payments. Your credit will continue to get worse instead of better. The only exceptions are accounts that have already been charged off or have gone to collections. If you have to choose between paying a collection account or paying an account that’s current, pick the account that’s current.

- Sending letters without certified mail.

When you send letters to credit bureaus, collection agencies, lenders, and creditors, you should always send via certified mail with return receipt requested. That gives you proof that your letter has been sent and whether it’s been received.

- Not checking your credit report.

Before you ever begin repairing your credit, you should check your credit report. Your credit report will help you figure out what items you need to focus on to improve your credit. Without a copy of your credit report, you’ll have a hard time figuring out where to start repairing your credit.

- Filing bankruptcy.

You should not use bankruptcy as a credit repair tactic. Bankruptcy will not improve your credit and in some cases, your credit can get worse after filing bankruptcy. Since bankruptcy remains on your credit report for 7 – 10 years, you’ll continue having trouble getting credit cards and loans. Most lenders ask if you’ve ever filed bankruptcy, so even after bankruptcy falls off your credit report, it can still keep you from getting a loan.

11. Not Research additional Information

So, you can begin your research for more tips and ideas for dealing with debt or credit score improvement from places such as Debt Management Ideas

| Debt Management Ideas |

Life will be easier for you.

Once you get on the right side of understanding ‘bad credit’, you may want to consider other income sources as often issues with your credit can come from many sources one of which is earning too little and spending too much.

If you’re interested in learning how to build an online business, that will allow you to work from anywhere in the world. One that will make it possible for you to earn money to pay down your debts (and many other benefits!) then check out my number one recommended online training course that you can begin for FREE.

So get behind the wheel and take Wealthy Affiliate for a test drive, it costs you nothing to try it out and see if it’s for you or not.

| Test Drive Wealthy Affiliate – here for free |

If you want to learn how to set up an online website completely from scratch, learn to make money online, learn how to use search engines to your advantage and to build a sustainable, long-term business, then I suggest that you take a look at Wealthy Affiliate. You don’t need a credit card or any money to get an education that will last you a lifetime and generate you a real income.

Finally

If you have enjoyed this post “Free Credit Score Online” feel free to share socially and leave a comment or ask a question below.

If you have enjoyed this post “Free Credit Score Online” feel free to share socially and leave a comment or ask a question below.

If you leave a comment on this post, I will reward you with a free copy of my 40+ page book; Affiliate Marketing Made Easy – sent directly to the email you use.

(You can learn how to make money online and build how to build an internet business).

So please accept my bribe and leave a comment. The book is awesome and so are you for leaving a comment!

I look forward to hearing from you, Thanks!

To bookmark this page for future reference you can do it now using (Ctrl+D)

Oh… Just one more thing, if you would like to receive a weekly newsletter, full of tips and advice about improving your credit score. Drop your details into the box below, so we know where to send them.

Interesting approach. I like your website and was looking for a way to fix my credit myself. Are there any other websites that you recommend? I would rather have someone going over my credit in person and telling me exactly what to do instead of handing over to a stranger. What do you think?

Hello, Sean. Thanks for your comments and yes many people do want someone else to help them with improving their credit however it is usually an expensive option. I am sending you a PDF copy of my book to help you and take you through the steps and these are things you can implement yourself. Take a look and see how easy they are. Enjoy 😉

I am in the process of repairing my credit now. I am so glad that I stumbled across your website! The process is a lot more involved than I ever imagined but in a good way. I did not realize how little I actually knew about this until I read your blog. I noticed you said that you were millions in debt. Within your book, do you share your story of how you got out of it? I think it will make for a great inspirational read. Thanks in advance and I look forward to hearing from you soon!

Hello, Denise. No not in that book. Although I cover it a little more in my post on don’t be a quitter which you are welcome to read. Thanks for your comments and look out for the ebook I am sending your way as a thank you for leaving a comment. 🙂

I love credit karma. I have been using it for about two years now and it has helped me stay on track with my credit score. I like how they break down your score and explain to you which aspect contribute more to your score and which one contributes the least.

When I started, it only offered scores fron transunion but now it has added equifax.

I agree that it all comes down to you. I was able to increase my score from below 500 to around 750 in two years.

Hello, Denise. Well done on improving your score and thanks for your comments. I am pleased you fund the post useful. Enjoy the ebook that is coming your way for leaving a comment. 🙂

Hello Peter,

Your site is so informative! This is facts that people really need to know to take control of their lives and finances, most people just bury their heads in the sand when it comes to understanding finances but knowledge is power. I believe you are creating something very valuable that would appeal to everyone. Great work!

Hello, and thank you for your comments. Yes and one of the biggest credit misconceptions is that checking your credit score will hurt your credit score but this is not the case. You can check your credit scores at Credit Karma as often as you like without affecting your credit score. Pleased you enjoyed the post 🙂

Hi Peter, a great read. I have to admit to have lost two restaurants and a bar in one go, going under isn’t fun! And it also affects your credit rating just a little. So the info on rebuilding your credit rating is somewhat helpful in fact it is a godsend. So thank you for that. I looked elsewhere only website some great motivational videos. Great site!

Hello, Donald appreciate the feedback thank you for your comments and I am pleased yu have found it helpful. 🙂

I just bookmarked this article because I have been working on my credit score for the past year now. I have brought it up significantly by using some of these methods that you mentioned. I will take all the help I can get though. I appreciate you going through the different ways to check it.

Hello, Shawn thank you for your comments and I am pleased you fund the post helpful 🙂

I think your website is amazing it is bright, clean, organized, and very informative. It helped to give me a few ideas of what to do with certain areas I was stumped on. I love post about “ditching goals” and forming “mini goals.” All in all I wouldn’t change anything. Best of luck. P.S. the review page really helped too.

Hello, Josh Thank you and you are welcome. Plese enjoy the book I am sending you Video Marketing Made Easy for leaving a comment it will give you addition information and resources about video marketing that you will find use and interesting that you can implement with little or no cost. Enjoy 🙂

I feel this is the type of stuff they should teach kids in highschool, most guys go out in the world not knowing what their credit score is ending up ruining it and having bad credit for most of their life. Education is the key, and I thank you for enlightening me further on the matter.

Hello, Jovan. Yes I totally agree, however, that’s assuming that the education system is to designed to ‘educate’ and not just turn us into tax paying working stiffs and consummers that can be exploited by those in power (but that’s another story for another day). Getting an education and self learning from such places as Wealth Affiliate is so awesome because it gives you the freedom to create you own lifestyle business and income without being dependent upon Government sponsored jobs and income. Thanks for your comments. 🙂

Hello, Peter, you offer invaluable information to the people who damaged credit scores in on one or different way.

I know that especially in the USA, it is easy to get credit cards. When people acquire credit cards, they think that they got free money. People know that it is not really free but they have a feeling that they can spend more.

There are some human beings who have clear minds.

Anyway, the majority of Americans are in debt.

I know by myself how is difficult to escape temptation in stores where you see some good deals. It does not matter that a pair of shoes will be seventh and my closet is full of clothes.

Now I found the way to escape this trap of the illusion that I can afford everything.

I left my credit cards at home. At the store I have cash. Most of all time I am a visitor, not a customer. It is the same as visiting the museum. I enjoy nice things without having them all at my home.

Your article will be a treasure for people who want fix their credit stories and maybe someday they will be responsible for their actions.

All the best, happy writing, Nemira.

Hello, NemiraB You are so right. We are not given enough information about credit and it’s use and how to manage it for our best interests.

Nobody will give for us information because the money comes from naive customers. When customers know less, more advantage banks get.

Hello NemiraB yes that’s true and this is why I am giving you the information here ha ha. Thanks for your comments 🙂

This might be complete rubbish, but I heard or read somewhere that if you get too many free credit score checks online that this in itself can downgrade your score. Is that right on any level?

I think I need to check my credit score as I will be reapplying for a mortgage soon, and I guess i need to know how to fix it. Maybe I should have thought about this a long time ago! Eek

Hello, Ruth Yes that is one of the biggest credit misconceptions, that checking your credit score will hurt your credit score.This is not the case. You can check your credit scores at Credit Karma as often as you like without affecting your credit score. ‘They’ encourage this rumor because it serves them for you to have your score lower than it could be as you will pay’them’ higher interest rates.

There are two kinds of inquiries they are either a hard or a soft inquiry. While both types of inquiries enable a third party to view your credit report, only hard inquiries can negatively affect your credit score. Also reviewing your credit reports regularly helps you to catch problems before they get out of hand and shows you what you need to work on before you need to get your credit checked.

Thank you for your comments and good luck with your mortgage. 🙂

Great information! I have seen many ads for Credit Karma and have been thinking about trying that out. However, I had a question. I know each time you run your credit report you get “dinged,” so if you check your credit report through the various sites, does that count as multiple dings? Or is it just when you are applying for credit that that happens?

Credit scores are so important. They effect pretty much everything you do, it seems like. Thank you for sharing ways to improve credit scores. I think I may get a copy of that book to help with my credit.

Thank you so much for the wonderful information.

Hello, Brandy One of the biggest credit misconceptions is that checking your own credit score using companies like Credit Karma will hurt your credit score. This is not the case. You can check your credit scores at Credit Karma as often as you like without affecting your credit score.

Another thing is that there are two kinds of inquiries that occur on your credit report. These are either a hard or soft inquiries. While both types of inquiries enable a third party to view your credit report, only hard inquiries can negatively affect your credit score. It’s in your interests to know the difference between the two.

These are all things that are covered in the book. Thank you so much for your comments 🙂

Hi,i liked the way you present your topic.

i am reading your post again

About the meat inside – this post is all about improving your Credit score – for me it means Borrowing. As a businessman I know the whole thing – for a simple mind if you borrow how do you earn online. the ship already has holes. Or is this just trying to buy into WA programs?

Take Care

Hello Manakaran, Sometimes those with credit problems have spent more than they are earning and hence they get into debt and then fall behind with their payments and their credit score suffers as a result. I give them some ideas in this post about how to fix their credit and offer a low cost ($5) solution should they want to know more.

I also recommend an income creation strategy that they can try If you want to learn how to set up an online business completely from scratch, learn to make money online, learn how to use search engines and to build a sustainable, long-term business.

I suggest they look at Wealthy Affiliate because you don’t need a credit card or any money to get an education that will get most people started, last a lifetime and potentially generate a real income. It has worked for me and hence the reason that I highly recommend it.

Thank you for your feedback and I hope you enjoy the Video Marketing Made Easy book that is on its way to you. 🙂

You do make a person want to get the book! I have to admit, part way through the article I thought you were just holding a carrot in front of me without giving me any info. But I kept reading and the info I wanted followed.

Wealthy Affiliate? I agree that we all need ways to make more income. But learning how to build a business from some online program – is it realistic?

Robin

Hello, Robin thank you for your comments and yes building a business, online via Wealthy Affiliate is absolutely possible. The post you just read and the entire site has come from the learning I got from Wealthy Affiliate. Prior to that, I had many websites and none of them made any money. I am very happy to report that this is not the case now. As you said you wanted to read more of the post, as you went along and happily you were not disappointed. That’s how it’s done when you get the right education about creating profitable websites online. Thank you again for your valuable feedback 🙂

Wow man that is a really in depth and detailed post :O Very impressive. Keep writing posts like that and you’ve just earned you a new follower of your website. It is very good, and it is very motivating to online business. It’s also very motivating to join WA. In my opinion it is overall a super good post!

Hello Daniel, Pleased you liked it and happy to know you are following me. I hope you enjoy the free book that coming your way for leaving a comment 🙂

Thank you so much for your great advices! Credit score is a pain in a butt. I’m not from america so when i just came to NY i had no credit score at all and because of it i couldn’t rent an apartment. I wish i found your article like 5 years ago! However, i still found few tips that i can use even now. Will read the full book for sure.

Hello Alisa Thank you for your comments and I am pleased you found the post interesting and helpful. I hope you also enjoy the Video Marketing Made Easy book I am sending your way for leaving a comment . Thanks for your feedback 🙂

Great explanation about credit scores. Since I’m not at the point of my life where I need to worry about this yet, you broke it down simply and explained how it all works. It’s actually pretty interesting. Thanks for including services that will help me find my future credit score for free. You wrote a lot about this. What would you suggest should be my first plan of action to maintaining a high credit score?

Hi Mate, A suggestion for you is to get yourself a credit card and to build up your “available credit” over time in order to improve your credit score. You then use it and pay back the credit on time Ideally, you need this ratio what you use and what available to use around 10-30% at any given time. This will show the credit rating companies you know how to use and repay credit responsibility. Thank you for your question and feedback 🙂

That is a really nice website. I can easily see all the time and effort that has gone into this. It really covers all aspects of the subject. Lots of good images. Arranged in a clean looking fashion and easy to navigate. It does give the impression that Peter does really know what he is talking about, and so trust is built. I have one suggestion though. Under the heading of “Getting Educated”, the first sentence seems to be structured incorrectly. In reading through the site, I noticed several other sentences that I don’t believe contained proper sentence structure. I don’t know if others have noticed this or not. It kind of stood out for me though. So my suggestion is to go through the entire site, looking for these sentence that could use a little modification to make them flow better. Thanks for the opportunity to comment on this very nice site. Jim

Hello Jim thank you for your comments and the review of my site and the good advice and I am pleased you liked the layout and style. Thank you for thanking the time to read it 🙂

Thank you for the very useful information on obtaining my free credit score. I’ve payed for this service in the past and have been constantly duped and rebilled with their small print tactics. I’m looking to buy a house in the near future so knowing my credit score before creditors is paramount. Thank you so very much for allowing me to finally find out this useful information. Your site is the best!

Hello Bimmerguy Thank you for your feedback and I am pleased you found the post helpful as I’m sure the information in the book is also invaluable. Cheers and best luck for your up coming house purchase :).

Nice post you have here, Peter. It saddens me to see people having a bad credit score which puts many of them in such financial ruin. Once that happens, it feels like they can’t seem to get out of it. Although, my credit score is good, not bad, but good. I feel that it’s best to pay off bills on time, no matter what. After reading your post, I’ll refer to what you have to say here to prevent from having to pay high interest rates by having a having a bad score.

Armand

Hello Armand Yes there is much we can do to improve the score we have if we only knew what to do. Thank you for your comments and all the best for the future 🙂

I keep track of my credit score quite regularly on Credit Karma, but I wasn’t always that way. My credit score was pretty rough for a while because I wasn’t paying attention to it. I got a secured credit card and started rebuilding my credit and I have improved it quite a bit. I am still working on paying down debt, so hopefully it will keep going up! Thanks for the good advice

Hello David you are most welcome. I am pleased you got value from my post and I wish you further success in your endeavours. Thank you for your comments 🙂

Peter the best thing about your POST and the one thing that really struck me was the Design and Presentation. Loved the image and the real clear cut font and set up. Was really refreshing.

About the meat inside – this post is all about improving your Credit score – for me it means Borrowing. As a businessman I know the whole thing – for a simple mind if you borrow how do you earn online. the ship already has holes. Or is this just trying to buy into WA programs?

Take Care

Hello Rowan thank you for your comments. The thing about Wealthy Affiliate is that you can learn about making money online beginning for free so if you have bad credit and debts you don’t need to worry about not affording to get started with an education from which you could earn yourself an income online. Too often people with poor credit and debt have earned too little and spent too much, so this is a place which almost anyone can learn to create an online business and get another start in life. 🙂

I’m rereading your post again. So I know that your credit score is calculated from payment history, amounts owed, lengths of credit history, new credit, and types of credit used. What if I never used the credits tough? Because I know that using credit is bad for long term payment, they are way lot more expensive.

Hi RenO thank you for your question. If you get credit, say a credit card then you need to use it and pay it back (even though you may not need to use it) in order to establish a ‘credit rating’. By doing this proves to the credit provider that you are responsible and can and do pay back the credit given to you. The trick is to only stay within the 30% threshold of ‘available credit‘ and the credit actually used. By doing this you will get a good credit rating very quickly. This will led to offers of even more credit and as long as you ‘play the game’ you will soon have excellent credit in no time at all. Hope that answers your question 🙂

Whoa! So many information. Good review I say. It was really interesting reading all those. I don’t have a system such as this in my country, so reading this is really giving me a new knowledge! It really is hard to pay the bill this time. Thanks for the post!

Hello RenO You are welcome. The information is is still good even if you don’t have this exact credit scoring system in your country there will still be some thing that the credit agencies will use to rate creditors. I am pleased you found the information helpful and thank you for your comments. 🙂