Free Credit Score Online

FREE CREDIT SCORE ONLINE

There are several ways to obtain a Free Credit Report Online, and I’m going to give them to you right here. You can contact the following sources directly by visiting;

- https://www.annualcreditreport.com/

- Experian https://www.experian.com/

- TransUnion https://www.transunion.com/

- Equifax https://www.equifax.com/

There is also another website for getting a free credit report online with the additional advantage that they will monitor your credit and future credit inquiries. They will email you about any new developments to your credit score.

You can check it at Credit Karma.

One of the biggest credit misconceptions is that checking your credit score will hurt your credit score.

This is not the case. You can check your credit scores at Credit Karma as often as you like without affecting your credit score.

What to do Next

You will need to view all these sources to make sure they are scoring you all the same, and once you have your credit report(s), then we can get to work on improving your credit score. You should also research as much information as you can about debt management.

Having the best credit score, you possibly can is important because your Credit score will affect your mortgage rates, credit card approvals, apartment rental requests, and even job applications.

Also reviewing your credit reports regularly helps you to catch potential problems, before they get out of hand, such as detecting identity theft, which can devastate your credit rating.

Knowing what to look for will also help prevent future, long-term credit related problems and understanding how your credit score is calculated another important step towards improving your credit rating.

How is Your Credit Score Calculated?

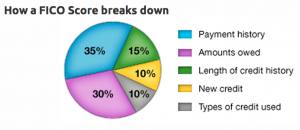

As you can see; it’s your payment history and the amount you owe that makes up 65% of your score. This, together with how long you have had any credit, makes up 80% of your FICO score.

These are the major components that go towards calculating your overall credit score and these have all taken ‘time‘ to acquire and compile.

Most People Have a Poor Score

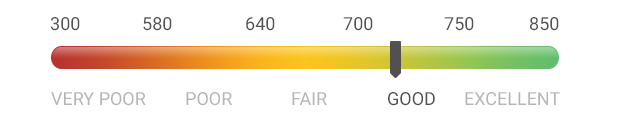

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.

What may surprise you is that most Americans have ‘Poor to Fair’ scores, and many are also up to their ears in debt.

The chances are that you also have a poor credit score, and you’re looking for ways to improve your score.

The good news is that’s simpler than you might think, and no, it doesn’t involve using agencies or expensive services.

In fact, it’s quite easy to improve your credit score on your own, and you can do it for free, it only takes some dedication, a little knowledge, and some will-power.

I have had my share of experiences with having bad credit, from not paying my bills on time. Having bad credit means having to endure higher interest rates and lots of harder work to reduce your debts due to harsher terms and longer payment plans that you get stuck with.

Wait – Didn’t I just say that improving a bad credit score was easy? Why did I just say it was hard for me?

Well… because for me, it was hard because, I owed millions of dollars and had filed for bankruptcy. I initially thought it would be really tough to improve my credit rating, increase my credit score, so I could reduce my interest payments to a more acceptable level.

I was searching for someone to help me with my problems, I went through a lot of agencies and service providers, I tried many different techniques, to improve my credit score. I read a lot of books and tested many strategies and during my search for a solution, I discovered something interesting…

It turns out, it all came down to me. I was the solution.

So, after trying many advertised courses and agencies to improve my credit score, and failing. I decided to take matters into my hands.

I figured out that there are a few simple but concrete steps that almost anyone can make, to improve their credit score – by at least 100 points, in a few short months, possibly even in a few weeks.

These are simple steps, and I wished someone told me about them earlier before I spent all my time and a lot of money on other courses and products which only lead to frustration and further debt.

Well…

Since you’re reading this post, there’s a good chance that you’re looking for ways to improve your credit score as well.

There’s no need for third-party services or accountants; it’s all in your hands… and it’s quite simple.

I outline the steps and provide the information you need to improve your credit rating in my book. In this book is what I wished I found when I was suffering from poor credit. I say suffering because of having a poor credit score is like suffering needlessly with poor health when the cure is only a course of antibiotics and a little time. – If only you knew!

It’s the exact information that I needed to know, to not only improve my credit score but this information has allowed me to maintain a high score, ever since.

I will always have a great credit score now that I found out how to efficiently manage my score – and I’ll show you how you can do the same.

See the Video below for more information:

[To get this book use this link] » Read more