How to Work Online from Home

How to work online from home comes down to choice and motivation. Many people want to know how to make money working online. I can give you the motivation and give you the ‘how‘ with this article. But the final decision to actually do it, is yours.

Many people overlook the most obvious benefit of working online from home which is the ability to control and manage your own financial destiny. Making money online is not difficult, once you know the how. But too often people fail online because they gave up way before they put all the pieces together. And there are a lot of pieces.

Making It Easy

Fortunately, I’m going to make it easy for you and give them ALL to you. I am even going to tell you how & where you can join a world class training community that you can start for free and where to access 300 ‘How to’ videos, that cover everything you will ever need to know about how to work online from home.

But first, let’s get you motivated to wanting to work online. Here are some powerful reasons, to make you think hard about getting started.

Some Background

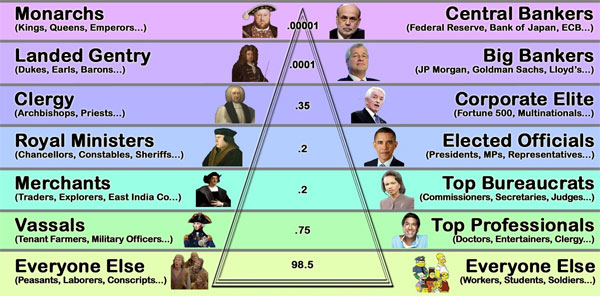

“I have written before about the Government being the biggest problem for the people of the world when it comes to wealth creation and that they are not the benefactors they pretend to be”.

They are actually detrimental to your economic well-being and its time for you to take personal responsibility and create your own online business to save yourself from their mismanagement.

Let Me Explain…

Why I say that Governments are not your friends and they are no looking out for you. Let me give you an example. Many people assume that China will one day become the next superpower and perhaps they might. But things are not always as them seem.

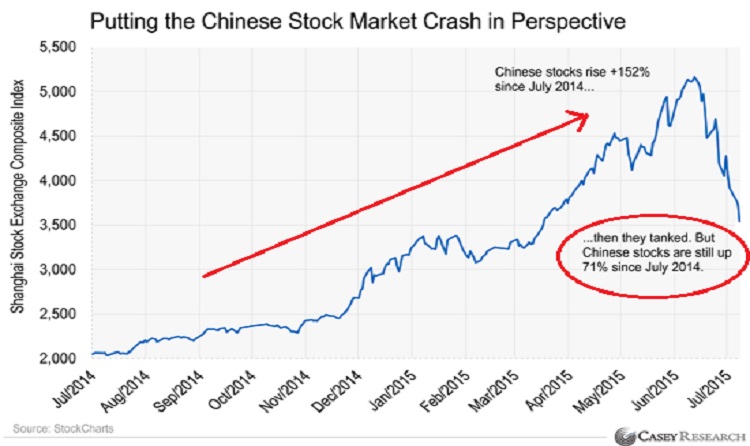

Not so long ago, the Chinese stock markets lost more than 3 trillion dollars in less than a month, following a strong bull market, that had risen 152% over a twelve month period, up until June 2015, before China’s two biggest stock markets suddenly plummeted.

Bubbles always burst much faster than they grow and after expanding for over a year, Chinese stocks crashed 35% in three weeks, meaning that Chinese companies lost around $3.2 trillion worth of value in less than a month.

A stunning loss of wealth and to put this in perspective that’s double the size of the entire stock market of Australia. Yet even though the drop is huge the Shanghai Index is still up 71% from a year ago, so perhaps it still has further to fall.

Why do these things happen? (More about that soon...)

Not the First Time

What you may not remember was that China led the global collapse in 2008, when the stock market ‘bubble‘ at that time saw a massive rise in just two short years before suddenly dropping 72%. So, recent events are not the first time the Chinese stock market has imploded and it won’t be the last.

In Response

In response to the meltdown in 2008 the government (in line with Keynesian economics) pumped Trillions into their economy, building hundreds of thousands of apartment blocks, commercial buildings and developing infrastructure, massively ‘overbuilding‘ basically everything.

Resulting in having real estate and industrial capacity 12 to 15 years ahead of demand. But they didn’t care, they did this to stimulate their economy and to provide jobs for half a billion people who had moved from rural areas to urban cities, looking for work.

Increased GDP

This government funded real estate construction program, artificially boosted the economy and drove up the country’s GDP – making the communist economy look successful, as they weathered the global economic meltdown, becoming the envy of the western world. Despite creating a huge hidden real estate bubble.

This unprecedented overhaul of their economy had actually been going on for decades, but really only got traction from 2009 and after five years of rapid growth, the Real Estate market began to slow, as the number of unsold properties mounted in the face of continued overbuilding and weakening demand.

Economic Out-Look

Economic growth has begun slowing, home prices are deflating (despite offical figures to the contrary) and most local governments are facing a potential debt crisis from all the massive building being undertaken with borrowed funds.

But that’s not all, this is also the same country, where families are only allowed ONE baby and some of those are now in their mid twenties and are also only having one child. But the majority of these babies are still children so, the future demand for ‘Real Estate’ is unlikely to be greater than it was, thirty years ago, when families had five or six children.

What this means is that for every child in China, over the next twenty years or so, there will be up to six older (non working) family members that will need looking after. In other words the ageing population will be massive as the population is shrinking. Making the excess of real estate a larger problem than it is currently.

the Tech Billionaire Entrepreneur character, Tony Stark played by actor, Robert Downey Jr, in the Iron Man movie franchise.

the Tech Billionaire Entrepreneur character, Tony Stark played by actor, Robert Downey Jr, in the Iron Man movie franchise.